UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

| KODIAK GAS SERVICES, INC. |

| (Name of Registrant as Specified in its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| þ | | No fee required. |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING &

2025 PROXY STATEMENT

| | | | | | | | | | | | | | | | | | | | | | | |

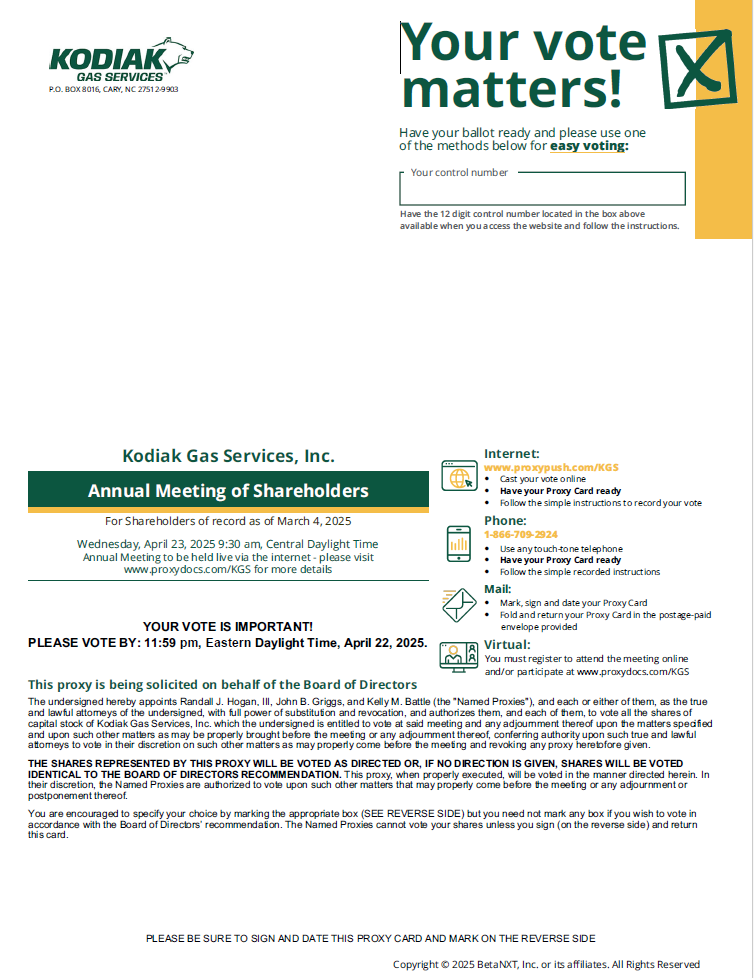

Notice of 2025 Annual Meeting of Shareholders | | | | | |

| | | | |

| | | | | | | |

| | | | AGENDA | |

2025 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD VIRTUALLY:

www.proxydocs.com/KGS

DATE AND TIME:

April 23, 2025 9:30 am Central Daylight Time | | | |

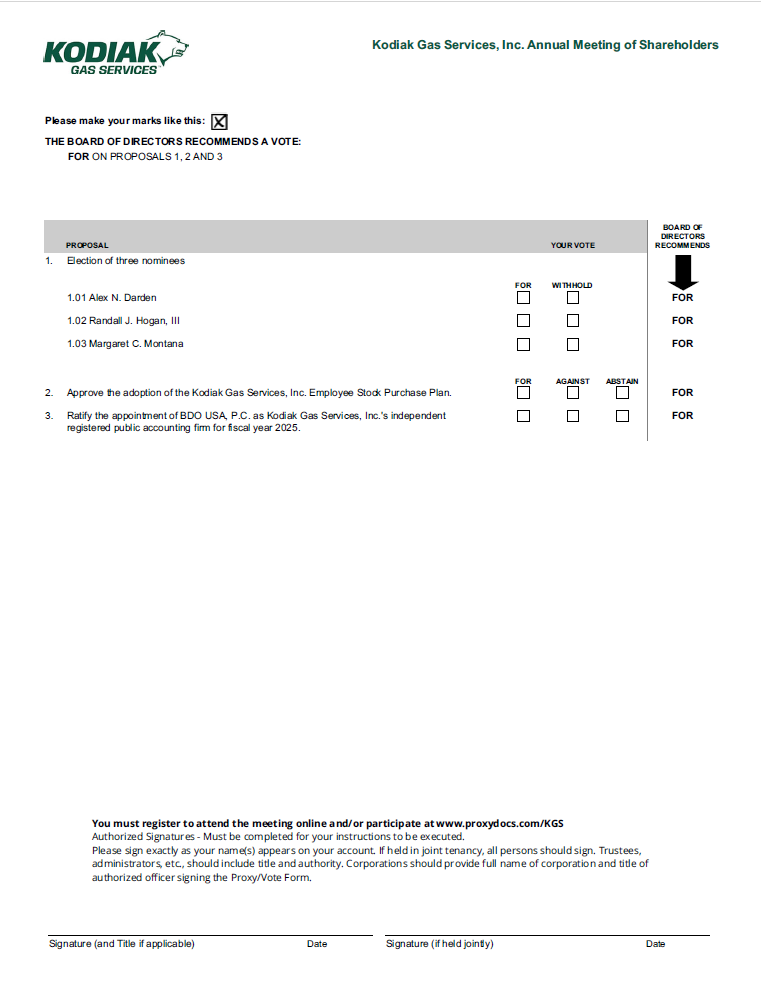

| | 1 | Election of three nominees identified in the accompanying proxy statement to serve as Class II directors until the 2028 annual meeting and until their successors are duly elected and qualified; | |

| | 2 | Approve the adoption of the Kodiak Gas Services, Inc. Employee Stock Purchase Plan (the “ESPP”); | |

| | 3 | Ratify the appointment of BDO USA, P.C. as Kodiak Gas Services, Inc.’s independent registered public accounting firm for fiscal year 2025; and | |

| | | | 4 | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. | |

Who may vote:

Shareholders of record at the close of business on March 4, 2025, will be entitled to notice of and to vote during the 2025 Annual Meeting of Shareholders (the “Annual Meeting”) and at any adjournments or postponements thereof.

How to attend:

To be admitted to the Annual Meeting, you must register in advance at www.proxydocs.com/KGS by using the voting control number found on your proxy card. Upon completing your registration, you will receive further instructions via e-mail, including a unique link that will allow you access to the meeting. You will not be able to attend the Annual Meeting in person.

The Woodlands, Texas March 17, 2025

By Order of the Board of Directors Kelly M. Battle Executive Vice President, Chief Legal Officer, Chief Compliance Officer and Corporate Secretary | | |

| | | |

| VOTING METHODS AVAILABLE TO YOU | |

| | The Internet Visit the website shown on the proxy card (www.proxypush.com/KGS) and follow the instructions at that website at any time prior to 11:59 pm Eastern Daylight Time on April 22, 2025; | |

| | By Telephone Within the United States (U.S.) or Canada, call the toll-free number shown on the proxy card and follow the instructions at any time prior to 11:59 pm Eastern Daylight Time on April 22, 2025; | |

| | By Mail If you receive a paper copy of the proxy materials, complete, sign and date the proxy card and return the proxy card in the prepaid envelope. Your proxy card must be received by the Company before the voting polls close during the Annual Meeting; or | |

| | During the Meeting If you are a shareholder of record on the record date, you may vote online during the Annual Meeting via the internet at www.proxydocs.com/KGS. | |

| | | |

| | | | | | | |

| | | | | | | | |

| | |

| Beginning on or about March 21, 2025, the Company mailed our Notice of Annual Meeting of Shareholders, Proxy Statement and form proxy card for the Annual Meeting and our Annual Report on Form 10-K for the year ended December 31, 2024. The Company’s Proxy Statement and 2024 Annual Report are available at www.proxydocs.com/KGS. | |

| | |

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Proposal 1 - Election of Class II Directors | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Proposal 2 - Approval of Adoption of the Kodiak Gas Services, Inc. Employee Stock Purchase Plan | | |

Proposal 3 - Ratification of Appointment of Independent Registered Public Accounting Firm | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Annex A - Kodiak Gas Services, Inc. Employee Stock Purchase Plan | | |

GENERAL INFORMATION

Our Business

Kodiak Gas Services, Inc. (“Kodiak”) is a leading operator of contract compression infrastructure in the United States. Our compression operations are critical to our customers’ ability to reliably produce and transport natural gas and oil to support growing global energy demand. We are a market leader in the Permian Basin, which is the largest producing natural gas and oil basin in the United States. We operate our large horsepower compression units under stable, fixed-revenue term contracts with blue-chip upstream and midstream customers.

In this Proxy Statement, we refer to Kodiak Gas Services, Inc. as “Kodiak”, the “Company”, “we”, or “us”.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board of Directors

The Kodak board of directors (the “Board” or “Kodiak Board”) currently consists of nine members. The number of members of the Kodiak Board will be determined from time to time by resolution of the Kodiak Board. The Kodiak Board is divided into three classes of directors, with each class as equal in number as possible, serving staggered three-year terms. Class I, Class II and Class III directors will serve until our annual meetings of shareholders in 2027, 2025 and 2026, respectively.

In evaluating director candidates, we assess whether a candidate possesses the integrity, judgment, knowledge, experience, skills and expertise that are likely to enhance the Board’s ability to manage and direct our affairs and business, including, when applicable, to enhance the ability of the committees of the Board to fulfill their duties.

The following table sets forth the director class, name, age as of March 17, 2025, and other information for each member of our Board:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Director

and/or

Executive

Officer Since | | Current

Board

Term

Expires | | Expiration of

Term for

Which

Nominated |

| Alex N. Darden | | 50 | | Class II Director | | 2023 | | 2025 | | 2028 |

| Randall J. Hogan, III | | 69 | | Class II Director and

Chairperson of the Board | | 2023 | | 2025 | | 2028 |

| Margaret C. Montana | | 69 | | Class II Director | | 2023 | | 2025 | | 2028 |

| Terry B. Bonno | | 67 | | Class III Director | | 2023 | | 2026 | | |

| Chris Drumgoole | | 49 | | Class III Director | | 2023 | | 2026 | | |

| Nirav Shah | | 38 | | Class III Director | | 2023 | | 2026 | | |

| Jon-Al Duplantier | | 57 | | Class I Director | | 2023 | | 2027 | | |

| Gretchen Holloway | | 50 | | Class I Director | | 2023 | | 2027 | | |

| Mickey McKee | | 47 | | Class I Director,

President and Chief Executive Officer | | 2023 | | 2027 | | |

Selection of Board Nominees / Director Criteria

The Board has overall responsibility for the selection of candidates for nomination or appointment to the Board. The Nominating, Governance & Sustainability Committee will recommend director candidates to the Board for nomination or appointment. The Board’s policy is to encourage selection of directors who will contribute to the Company’s overall corporate goals. The Board and the Nominating, Governance & Sustainability Committee will annually review the experience and

characteristics appropriate for Board members and director candidates in light of the Board’s composition at the time, and the skills and expertise needed for effective operation of the Board and its committees.

The director criteria the Board considers, based on the recommendations of the Nominating, Governance & Sustainability Committee, will include:

Ethics

Directors should be persons of good reputation and character who conduct themselves in accordance with high personal and professional ethical standards, including the policies set forth in the Company’s Code of Conduct.

Conflicts of Interest

Each director should not, by reason of any other position, activity or relationship, be subject to any conflict of interest that would impair the director’s ability to fulfill the responsibilities of a member of the Board.

Independence

The Board will consider whether directors and nominees will be considered independent under the standards of the New York Stock Exchange (“NYSE”), and the heightened independence standards for Audit Committees and Compensation Committees under the securities laws.

Business and Professional Activities

Directors should maintain a professional life, active enough to keep them in contact with the markets and/or the industry in which the Company is active. A significant position or title change will be seen as a reason to review a director’s membership on the Board.

Experience, Qualifications and Skills

Directors should have the educational background, experience, qualifications and skills relevant for effective management and oversight of the Company’s management, which may include experience at senior executive levels in comparable companies, public service, professional service firms, or educational institutions.

Time / Participation

Directors should have the time and willingness to carry out their duties and responsibilities effectively, including time to study informational and background materials and to prepare for meetings. Directors should attempt to arrange their schedules to allow them to attend all scheduled Board and committee meetings. The Board will consider the participation of and contributions to the activities of the Board for any director recommended for renomination.

Board Evaluation

The Board will consider the results of the Annual Board Evaluation in its Board refreshment strategy.

Overboarding

Accepting a directorship with another company that the director did not hold when elected or appointed to the Board will be seen as a reason to review a director’s membership on the Board.

Tenure / Retirement

The Board does not believe that there should be a fixed term for directors but will consider each director’s tenure and the average tenure of the Board.

Shareholder Recommendations for Board Nominees

The Nominating, Governance & Sustainability Committee evaluates director candidates recommended by shareholders in the same way it evaluates candidates recommended by all other persons. Shareholders wishing to submit recommendations for director candidates for consideration by the Nominating, Governance & Sustainability Committee must provide the information specified in our Bylaws to the Company’s Corporate Secretary at Kodiak Gas Services, Inc., 9950 Woodloch Forest Dr., Suite 1900, The Woodlands, TX 77380 within the time period specified in our Bylaws.

Committees of the Board of Directors

The Kodiak Board has three standing committees: the Audit & Risk Committee, the Nominating, Governance & Sustainability Committee and the Personnel & Compensation Committee. Additionally, we may have such other committees as the Kodiak Board shall determine from time to time. Each of the standing committees of the Kodiak Board has the composition and responsibilities described below.

Audit & Risk Committee

The Audit & Risk Committee consists of Gretchen Holloway, Margaret C. Montana and Chris Drumgoole, each of whom is independent under U.S. Securities and Exchange Commission (“SEC”) rules and NYSE listing standards. Ms. Holloway serves as Chairperson of the Audit & Risk Committee. As required by the SEC rules and NYSE listing standards, the Audit & Risk Committee consists solely of independent directors. SEC rules also require that a public company disclose whether its audit committee has an “audit committee financial expert” as a member. We have determined that Gretchen Holloway satisfies the definition of “audit committee financial expert.” The Audit & Risk Committee oversees, reviews, acts on and reports on various auditing and accounting matters to the Kodiak Board, including the selection of our independent accountants, the scope of our annual audits, fees to be paid to the independent accountants, the performance of our independent accountants and our accounting practices. In addition, the Audit & Risk Committee oversees the process of reviewing the principal risks associated with the Company’s business, as well as our compliance programs relating to legal and regulatory requirements. The Audit & Risk Committee Charter adopted by the Kodiak Board defines the committee’s primary duties in a manner consistent with the rules of the SEC and the listing standards of the NYSE.

Nominating, Governance & Sustainability Committee

The Nominating, Governance & Sustainability Committee consists of Jon-Al Duplantier, Alex N. Darden and Terry B. Bonno, each of whom is independent under NYSE listing standards. Mr. Duplantier serves as Chairperson of the Nominating, Governance & Sustainability Committee. The Nominating, Governance & Sustainability Committee identifies, evaluates and recommends qualified nominees to serve on the Kodiak Board, develops and oversees our internal corporate governance processes and the Company’s sustainability objectives. The Nominating, Governance & Sustainability Committee Charter adopted by the Kodiak Board defines the committee’s primary duties in a manner consistent with the rules of the SEC and the listing standards of the NYSE.

Personnel & Compensation Committee

The Personnel & Compensation Committee consists of Terry B. Bonno, Jon-Al Duplantier and Randall J. Hogan, III, each of whom is independent under SEC rules and NYSE listing standards. Ms. Bonno serves as Chairperson of the Personnel & Compensation Committee. The Personnel & Compensation Committee establishes salaries, incentives and other forms of compensation for officers and other employees; administers our incentive compensation and benefit plans; and oversees the development, implementation and effectiveness of the Company’s human capital management practices, policies, strategies and goals. The Personnel & Compensation Committee Charter adopted by the Kodiak Board defines the committee’s primary duties in a manner consistent with the rules of the SEC and the listing standards of the NYSE.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serve on the board of directors or compensation committee of a company that has an executive officer that serves on the Kodiak Board or Personnel & Compensation Committee. No member of the Kodiak Board is an executive officer of a company in which one of our executive officers serves as a member of the board of directors or compensation committee of that company.

Board and Committee Meetings

We became a public company upon the completion of our Initial Public Offering (“IPO”) in July 2023. Members of each committee are recommended by the Nominating, Governance & Sustainability Committee, except for members of the Nominating, Governance & Sustainability Committee which are recommended by the Chairperson of the Board. Committee members are elected by the Board at its first meeting following the annual meeting of shareholders to serve for one-year terms.

All of the current members of our committees are independent. Directors are expected to attend the annual meeting of shareholders and all or substantially all of the Board meetings and meetings of committees on which they serve. All nine of our directors attended our 2024 annual meeting of shareholders. In 2024, each director attended at least 75% of the meetings of the Board and the total number of meetings held by any of the committees of the Board on which the director served during such director’s tenure. The following reflects the members of our current committees:

| | | | | | | | | | | | | | |

| Director | Independent | Audit & Risk | Personnel & Compensation | Nominating, Governance & Sustainability |

| Randall J. Hogan, III* | Yes | | ● | |

| Terry B. Bonno | Yes | | C | ● |

| Alex N. Darden | Yes | | | ● |

| Chris Drumgoole | Yes | ● | | |

| Jon-Al Duplantier | Yes | | ● | C |

Gretchen Holloway ** | Yes | C | | |

| Mickey McKee | No | | | |

| Margaret C. Montana | Yes | ● | | |

| Nirav Shah | Yes | | | |

| Number of 2024 Meetings | 9 (Board Meetings) | 6 | 6 | 4 |

*Chairperson of the Board |

| ● Member | | ** Financial Expert |

C Chairperson | | | | |

Additionally, the rules of the NYSE require that non-management directors of a listed company meet periodically in executive sessions and that independent directors meet in executive session at least once a year. The Company’s independent directors met separately in executive session at least four times during 2024. Mr. Hogan, the independent Chairperson of the Board, presided over the executive sessions of independent directors.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE DIRECTOR NOMINEES

PROPOSAL 1 - Election of Class II Directors

Our Board recommends that the nominees below be elected as members of the Board at the Annual Meeting.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Director

and/or

Executive

Officer Since | | Current

Board

Term

Expires | | Expiration of

Term for

Which

Nominated |

| Alex N. Darden | | 50 | | Class II Director | | 2023 | | 2025 | | 2028 |

| Randall J. Hogan, III | | 69 | | Class II Director and

Chairperson of the Board | | 2023 | | 2025 | | 2028 |

| Margaret C. Montana | | 69 | | Class II Director | | 2023 | | 2025 | | 2028 |

The Board, acting on the recommendation of our Nominating, Governance & Sustainability Committee, has nominated the three individuals named above for election as Class II directors. Each nominee is currently a director.

Class II Director Nominees to Serve for a Three-Year Term Expiring at the 2028 Annual Meeting

| | | | | | | | |

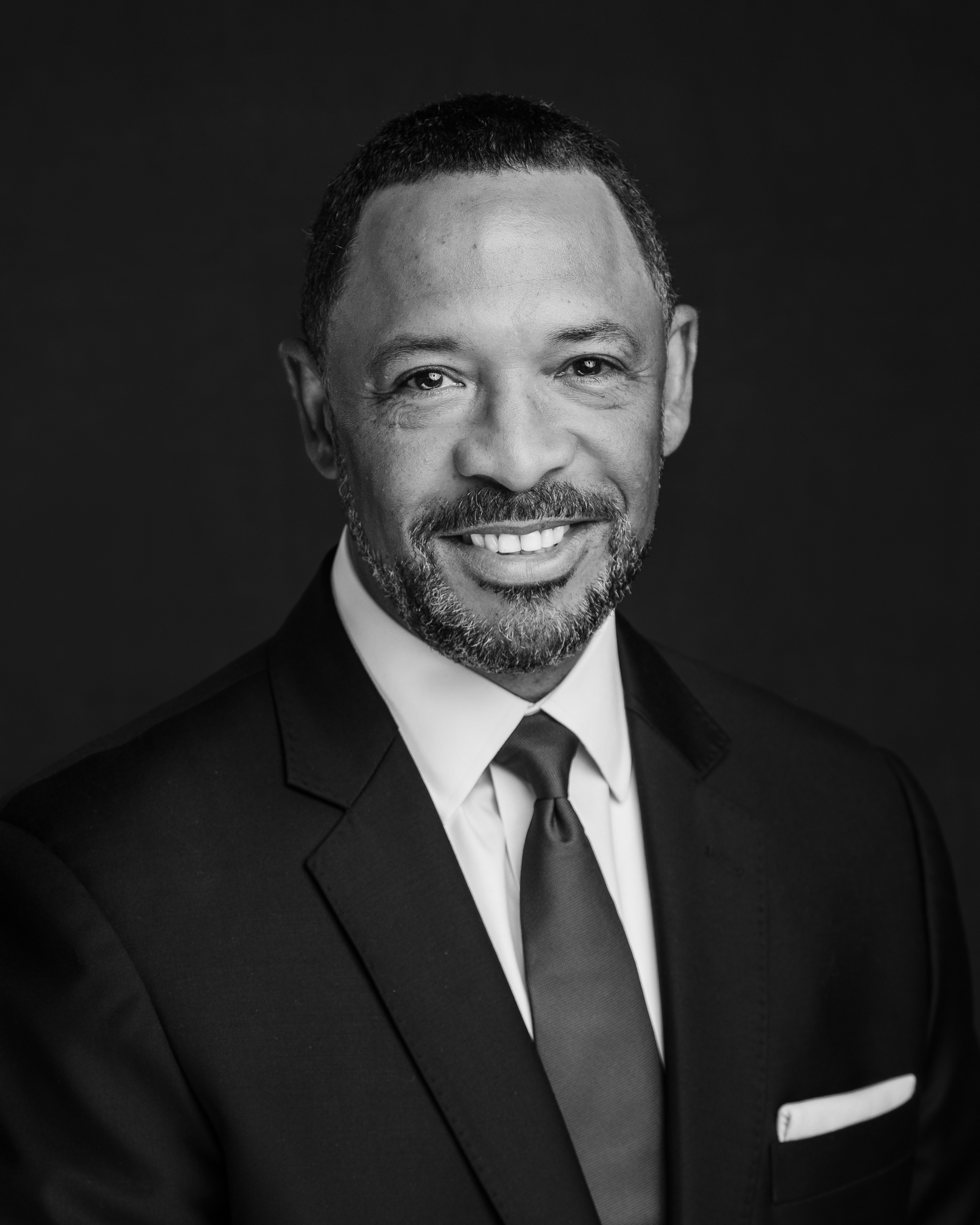

| | Alex N. Darden - Independent Director |

| |

Alex N. Darden has served as a director of the Kodiak Board since June 2023 in conjunction with our IPO. Prior to the IPO, he served as a member of the board of directors of another Kodiak subsidiary from January 2019 through June 2023. Mr. Darden currently serves as Chairman and President of EQT Partners Inc. (“EQT Partners”) and Head of EQT Infrastructure Advisory Team Americas. He currently serves as executive officer and a director of EQT Infrastructure Company LLC, a holding company that seeks to acquire, own and control joint venture portfolio companies in the infrastructure sector. Prior to joining EQT Partners in 2008, Mr. Darden worked at GE Energy Financial Services where he invested in energy industry assets and companies. From 1998 to 2002, Mr. Darden held various positions within ABB Inc., a technology leader in electrification and automation. He is also currently serving on the board of directors of Madison Energy Infrastructure, a privately-held company that develops, constructs, owns, and operates distributed generation and energy storage assets within the commercial, industrial and small utility-scale sectors and Cypress Creek Renewables, LLC, a leading privately-held national solar generation and energy storage company. He previously was a member of the board of directors of Covanta Holding Corporation, Fenix Marine Services, Ltd., Contanda Terminals LLC, Direct ChassisLink Inc., Peregrine Midstream Partners LLC, Restaurant Technologies Inc and Synagro Technologies Inc. Mr. Darden received a Bachelor of Science in Business from North Carolina State University. We believe that Mr. Darden’s extensive leadership experience, skills and background qualify him to serve as a member of the Kodiak Board. |

| | | | | | | | |

| | Randall J. Hogan, III - Independent Director |

| |

Randall J. Hogan, III has served as an independent Chairperson of the Kodiak Board since June 2023 in conjunction with our IPO. Prior to the IPO, he served as Chairperson of the board of directors of another Kodiak subsidiary from January 2019 through June 2023. He has also served as a member of the board of directors of Medtronic plc (NYSE: MDT), a healthcare technology leader, since January 2015 and has been an Advisor to EQT since 2018. Mr. Hogan previously served as a director of nVent Electric plc (NYSE: NVT), a manufacturing company for electrical connection and protection products, from May 2018 through May 2024, and as Chairperson of nVent Electric plc from May 2018 to May 2023. Mr. Hogan served as the Chief Executive Officer of Pentair plc, an industrial manufacturing company, from 2001 to 2018 and as Chairperson of the Board from 2002 through 2018. Prior to his role as Chief Executive Officer of Pentair plc, Mr. Hogan held various leadership roles at Pentair plc including President and Chief Operating Officer from 1999 to 2000, and Executive Vice President and President of the Electrical and Electronic Enclosures Group from 1998 to 1999. Prior to joining Pentair plc in 1998, Mr. Hogan served as President of United Technologies’ Carrier Transicold Division, a provider of thermal management systems to the transportation industry. Before that, he served as Vice President and General Manager of Pratt & Whitney Industrial Turbines; held executive positions at General Electric; and served as a Consultant at McKinsey & Company. From 2008 to 2016, Mr. Hogan was a member of the board of directors of the Federal Reserve Bank of Minneapolis, including as Chairperson from December 2013 to January 2016. Mr. Hogan received a Bachelor of Science in Civil and Environmental Engineering from the Massachusetts Institute of Technology and a Master of Business Administration from the University of Texas at Austin. We believe that Mr. Hogan’s organizational leadership and board experience qualify him to serve as a member of the Kodiak Board. |

| | | | | | | | |

| | Margaret C. Montana - Independent Director |

| |

Margaret C. Montana has served as a director on the Kodiak Board since June 2023 in conjunction with our IPO. Prior to the IPO, she served as a member of the board of directors of another Kodiak subsidiary from February 2019 through June 2023. Ms. Montana has served since September 2020 as member of the board of directors of Gibson Energy Inc. (TSE: GEI.CA), a Canadian crude oil infrastructure company. Ms. Montana retired as Chief Executive Officer and President of Shell Midstream Partners G.P., LLC in June 2015, and served on its board of directors from June 2014 until March 2020. Ms. Montana served in many roles with Shell USA, Inc. from August 2004 to June 2015, including Executive Vice President, U.S. Pipelines and Special Projects and Executive Vice President, Supply and Distribution, where she was responsible for hydrocarbon supply to Shell’s downstream worldwide fuels manufacturing and marketing businesses. Ms. Montana has also served on the board of the Houston YMCA since 2009 and the Board of Trustees for Missouri University of Science & Technology since April 2018. Ms. Montana received a Bachelor of Science Degree in Chemical Engineering from the Missouri University of Science and Technology. We believe that Ms. Montana’s energy industry and senior executive and board experience qualify her to serve as a member of the Kodiak Board. |

Class III Directors (Terms Expiring in Fiscal Year 2026)

| | | | | | | | |

| | Terry B. Bonno - Independent Director |

| |

Terry B. Bonno has served as a director on the Kodiak Board since June 2023 in conjunction with our IPO. Prior to the IPO, she served as a member of the board of directors of another Kodiak subsidiary from February 2019 through June 2023. Additionally, she has served on the DNOW Inc. (NYSE: DNOW) board of directors and its audit committee since May 2014, and has served as a member of the DNOW Inc. environmental, social, governance and nominating committee since May 2022. From 2017 to the divestiture to 3i Group plc in 2019, Ms. Bonno served as a director of Tampnet Inc., an operator of offshore high-capacity communication networks. She also served as a director for several energy industry and charity boards. Since 2014, she has served on the board of Spindletop Community Impact Partners, a non-profit organization. In 2017, Ms. Bonno was chosen as an industry expert to serve in an advisory capacity to the National Offshore Safety Advisory Committee for a three-year term ending in 2020. Ms. Bonno also served as Senior Vice President of Industry and Community Relations for Transocean Ltd. from 2017 until her retirement in October 2018. Before that, Ms. Bonno served as Senior Vice President of Marketing for Transocean Ltd. from 2011 to 2017 and as Vice President of Marketing from 2008 to 2011, with oversight of Transocean’s marketing in fourteen countries. Previously, Ms. Bonno served in various director and management roles at Transocean Ltd., leading the marketing and contracts efforts for West Africa and the Americas from 2001 until 2008. Ms. Bonno received a Bachelor of Business Administration in Accounting from Stephen F. Austin State University, and she is a Certified Public Accountant. We believe that Ms. Bonno’s public and private company board experience, extensive industry experience and expertise in business development qualify her to serve as a member of the Kodiak Board. |

| | | | | | | | |

| | Chris Drumgoole - Independent Director |

| |

Chris Drumgoole has served as a director on the Kodiak Board since June 2023 in conjunction with our IPO. Mr. Drumgoole currently serves as Managing Director of the Global Infrastructure Services business, of DXC Technology Company, (NYSE: DXC), a role he has held since April 2023. He previously served as EVP and COO of DXC Technology Company from 2020 through 2023. Prior to joining DXC Technology, Mr. Drumgoole served as Global Chief Information Officer for General Electric (NYSE: GE), a role he assumed in April 2020 after servng as GE’s Chief Technology Officer since April 2014. Mr. Drumgoole joined GE from Verizon (NYSE: VZ) where he served as Chief Operating Officer of Verizon’s Teremark Cloud and Cybersecurity division. Prior to joining Verizon by acquisition, Mr. Drumgoole held a number of technology, cybersecurity, and executive roles at IBM, Cable & Wireless, and Savvis. Mr. Drumgoole served on the Board of Directors of PetSmart, Inc. where he was a member of the audit committee from November 2019 through the company’s acquisition in October 2023. Additionally, Mr. Drumgoole serves on the board of directors of ONUG, a technology leaders association, a role he has held since January 2016. He also sits on the Dean’s Advisory Board at Florida International University’s College of Engineering & Computer Science. Mr. Drumgoole also serves as President of the DXC Foundation, the corporate charitable foundation of DXC Technology. Mr. Drumgoole received a Bachelor of Business Administration in Management Information Systems from Pace University. We believe that Mr. Drumgoole’s executive leadership experience and technology strategy and management experience in complex technology environments qualify him to serve as a member of the Kodiak Board. |

| | | | | | | | |

| | Nirav Shah - Independent Director |

| |

Nirav Shah has served as a director on the Kodiak Board since August 2023 and previously served as a member of the board of directors of another Kodiak subsidiary from 2021 until 2022. Mr. Shah has been a Partner at EQT Partners Inc. since 2023 and, prior to that time, since 2014, has served in various positions managing existing portfolio investments and sources new investment opportunities. Since October 2021, Mr. Shah has served as a director on the board of Lumos, a privately-owned fiber internet provider in the U.S. Prior to joining EQT Partners, Mr. Shah worked at AMP Capital Investors, an infrastructure private equity firm focusing on investments in the energy, transportation and telecommunications sectors. Mr. Shah received a Bachelor of Science in business administration from the University of Michigan. We believe that Mr. Shah’s extensive investment experience in the energy and infrastructure space and expertise in business valuation, governance and financial management qualify him to serve as a member of the Kodiak Board. |

Class I Directors (Terms Expiring in Fiscal Year 2027)

| | | | | | | | |

| | Jon-Al Duplantier - Independent Director |

| |

Jon-Al Duplantier has served as a director on the Kodiak Board since June 2023 in conjunction with our IPO. Mr. Duplantier has been a member of the board of directors of Sitio Royalties Corp. (NYSE: STR), a mineral royalties company with interests in the Permian Basin and other U.S. basins, since December 2022; of Stellar Bancorp, Inc. (NYSE: STEL), a bank holding company, since October 2022; and, of AltaGas Ltd., a North American energy infrastructure company, since February 2021. Mr. Duplantier previously served as a member of the board of directors of Brigham Minerals, Inc., a publicly-traded mineral royalties company from February 2021 to December 2022 and of Allegiance Bancshares, Inc. from January 2021 to September 2022. Mr. Duplantier retired as President, Rental Tools and Well Services of Parker Drilling Company in July 2020 after serving in such capacity since April 2018. Prior to holding such position, Mr. Duplantier served as Senior Vice President, Chief Administrative Officer and General Counsel from April 2014 to March 2018, among other roles from September 2009 to April 2014. Parker Drilling Company filed for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code in December 2018. Prior to joining Parker Drilling Company, Mr. Duplantier served in many senior legal, commercial and environmental roles at ConocoPhilips from August 2002 to September 2009, including Senior Counsel, Exploration and Production; Managing Counsel, Indonesia; and Managing Counsel, Environmental, among other positions. Mr. Duplantier began his career as a patent attorney with E.I. Du Pont de Nemours and Company. Mr. Duplantier received a Juris Doctor from Louisiana State University and a Bachelor of Science in Chemistry from Grambling State University. We believe that Mr. Duplantier’s broad experience across commercial, governance and legal aspects of business, along with his professional and leadership experience qualify him to serve as a member of the Kodiak Board. |

| | | | | | | | |

| | Gretchen Holloway - Independent Director |

| |

Gretchen Holloway has served as a director on the Kodiak Board since June 2023 in conjunction with our IPO. Ms. Holloway has been a member of the board of directors of the Women Thrive Advisory Board since September 2022. Ms. Holloway has also served on the Board of Trustees of the Children’s Foundation since March 2024, and been a member of the Finance and Audit committee since July 2015. Ms. Holloway has served as Senior Vice President and Chief Financial Officer of ITC Holdings Corp., an energy company which owns and operates high-voltage electricity transmission networks, since July 2017, and she previously served as Vice President, Interim Chief Financial Officer and Treasurer from October 2016 to July 2017; Vice President and Treasurer from November 2015 to October 2016; Vice President, Finance from May 2014 to November 2015; and, various senior and director-level roles from January 2004 to May 2014. In her current role, Ms. Holloway is responsible for the company’s accounting, internal audit, treasury, financial planning and analysis, management reporting, risk management and tax functions. Prior to joining ITC Holdings Corp., Ms. Holloway held various financial roles at CMS Energy Corp. from November 1999 to January 2004. She served as a director of Caribbean Utilities Company, Ltd. from May 2021 to May 2023 and of Inforum, a professional organization designed to accelerate careers for women and boost talent initiatives for companies in Michigan, from May 2019 to May 2023. Ms. Holloway began her career in public accounting at Arthur Andersen. Ms. Holloway received a Bachelor of Business Administration in Finance from Western Michigan University. In 2023, Ms. Holloway completed the Advanced Management Program at the University of Chicago Booth School of Business. We believe that Ms. Holloway’s technical financial skills, business acumen and leadership experience qualify her to serve as a member of the Kodiak Board. |

| | | | | | | | |

| | Robert (“Mickey”) McKee |

| |

Robert (“Mickey”) McKee formed the Kodiak group of companies in 2010, and he has served as our President since formation and Chief Executive Officer since 2019. Mr. McKee has also served as a director on the Kodiak Board since June 2023 in conjunction with our IPO. Mr. McKee brings 22 years of experience to us with extensive background in natural gas compression operations. Prior to founding our predecessor, he was the Senior Vice President of Sales and Engineering for CDM Resource Management, LLC (“CDM”), a provider of contract natural gas compression operations, from 2003 to 2010. He also managed the Engineering and Fleet Management group, worked with vendors and OEM manufacturers, as well as managed the sales and marketing efforts of some of the highest growth areas at CDM, all the while building meaningful relationships with customers. Prior to that, Mr. McKee worked for two years in CDM’s Operations group researching and qualifying projects as well as installing compression equipment across Texas and Louisiana. He received a Bachelor’s Degree in Mechanical Engineering from Tulane University. We believe that Mr. McKee’s experience and deep knowledge of our business qualify him to serve as a member of the Kodiak Board. |

Corporate Governance

Insider Trading Policy; Prohibition on Hedging Transactions

We maintain an Insider Trading Policy governing the purchase, sale, and/or other dispositions of our securities by our directors, officers and employees, as well as by the Company, that we believe is reasonably designed to promote compliance with insider trading laws, rules and regulations, and the exchange listing standards applicable to us. A copy of our Insider Trading Policy was filed as Exhibit 19.1 to our Annual Report on Form 10-K for the year ended December 31, 2024.

In addition, our Insider Trading Policy prohibits directors, officers and employees from entering into any transaction designed to hedge or offset any decrease in the market value of our equity securities, including purchasing financial instruments (such as pre-paid variable forwards, equity swaps, collars and exchange funds), or otherwise trading in market options (such as puts or calls), warrants, or other derivative instruments of our equity securities. Any person wishing to enter into such an arrangement must first submit the proposed transaction for approval by the Chief Legal Officer.

Risk Oversight

The Kodiak Board is actively involved in oversight of risks that could affect us. This oversight function is conducted directly as well as through committees of the Kodiak Board, but the full Kodiak Board retains responsibility for general oversight of risks. The Audit & Risk Committee is charged with oversight of our system of internal controls and risks relating to financial reporting, legal, regulatory and accounting compliance. The Kodiak Board will continue to satisfy its oversight responsibility through full reports from the Audit & Risk Committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our Company.

Code of Conduct

The Code of Conduct adopted by the Kodiak Board is applicable to our employees, directors and officers, in accordance with applicable United States federal securities laws and the corporate governance rules of the NYSE. Any waiver of this code may be made only by the Kodiak Board and will be promptly disclosed as required by applicable U.S. federal securities laws and the corporate governance rules of the NYSE.

Corporate Governance Guidelines

The Corporate Governance Guidelines were adopted by the Kodiak Board in accordance with the corporate governance rules of the NYSE and serves as a general framework to assist the Kodiak Board in carrying out its responsibility for the business and affairs of Kodiak that are to be managed by or are under the direction of the Kodiak Board.

Clawback Policy

In June 2023, the Board adopted a clawback policy, consistent with the requirements of Rule 10D-1 under the Exchange Act of 1934, as amended (the “Exchange Act”), and the related NYSE listing standards, that requires an executive officer to repay or return erroneously awarded compensation in the event of an accounting restatement of previously-reported financial results.

Communication with the Company

Communication with our Board

Our Board and management believe strongly in the benefits of listening and communicating continually with a wide array of shareholders and stakeholders.

Shareholders or other interested parties may communicate with the entire Board or any individual member of the Board by writing to Randall J. Hogan, III, independent Chairperson of the Board, at the address provided below. All written inquiries will be immediately forwarded as directed. In addition, any concern or inquiry may be communicated to our Audit & Risk Committee or the Board by calling our Ethics Helpline at 1-844-989-1482 or by going to http://kodiakgas.ethicspoint.com.

Company Documents

We will provide to any shareholder or potential investor, free of charge, a copy of this Proxy Statement or Annual Report on Form 10-K for the year ended December 31, 2024. These documents are also available on our website at http://kodiakgas.com under the Investor Relations - SEC Filings tab.

Company Contact

Information relating to our corporate governance, including our Corporate Governance Guidelines, Code of Conduct, Committee Charters, information concerning our executive officers and members of our board of directors, and ways to communicate with us are available on our investor relations site at http://kodiakgas.com. We will provide any of the foregoing information without charge upon written request to our Corporate Secretary.

Kodiak’s Corporate Secretary and Investor Relations Departments can be contacted as follows:

By mail:

Kodiak Gas Services, Inc.

9950 Woodloch Forest Dr., Suite 1900

The Woodlands, TX 77380

Communication through our Ethics Helpline:

available by anonymous communication

by calling 1-844-989-1482 or http://kodiakgas.ethicspoint.com

By telephone: 1-936-539-3300

By email: ir@kodiakgas.com

EXECUTIVE OFFICERS OF KODIAK

Set forth below are the names, ages and positions of our executive officers as of March 17, 2025.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Mickey McKee | | 47 | | President and Chief Executive Officer |

| John Griggs | | 53 | | Executive Vice President and Chief Financial Officer |

| Chad Lenamon | | 49 | | Executive Vice President and Chief Operations Officer |

| Kelly Battle | | 54 | | Executive Vice President, Chief Legal Officer, Chief Compliance Officer and Corporate Secretary |

| Cory Roclawski | | 45 | | Executive Vice President, Chief Human Resources Officer |

| | | | | | | | |

| | Mickey McKee |

| |

Robert (“Mickey”) McKee formed the Kodiak group of companies in 2010, and he has served as our President since formation and Chief Executive Officer since 2019. Mr. McKee has also served as a director on the Kodiak Board since June 2023 in conjunction with our IPO. Mr. McKee brings 22 years of experience to us with extensive background in natural gas compression operations. Prior to founding our predecessor, he was the Senior Vice President of Sales and Engineering for CDM Resource Management, LLC (“CDM”), a provider of contract natural gas compression operations, from 2003 to 2010. He also managed the Engineering and Fleet Management group, worked with vendors and OEM manufacturers, as well as managed the sales and marketing efforts of some of the highest growth areas at CDM, all the while building meaningful relationships with customers. Prior to that, Mr. McKee worked for two years in CDM’s Operations group researching and qualifying projects as well as installing compression equipment across Texas and Louisiana. He received a Bachelor’s Degree in Mechanical Engineering from Tulane University. |

| | | | | | | | |

| | John Griggs |

| |

John Griggs has served as our Executive Vice President and Chief Financial Officer since January 2023. Prior to joining the Company, Mr. Griggs held Chief Financial Officer roles at Circulus Holdings, PBLLC, a leading plastics recycling company, from June 2021 to January 2023; Conquest Completion Services, LLC, a leading operator of high-capacity coiled tubing units for the natural gas and oil industry, from June 2018 to June 2021; and Rubicon Oilfield International, LLC, an oilfield products manufacturing company, from 2015 to June 2018. From 2011 through 2014, Mr. Griggs was a Managing Director at CSL Capital Management, an energy private equity firm. From 2005 through 2011, Mr. Griggs was a Senior Vice President for the direct capital arm of the D.E. Shaw Group where he focused on direct debt and equity investments in energy companies. Prior to 2005, Mr. Griggs served as an investment banker in the M&A department of Simmons & Company International, where he covered the oilfield service and midstream sectors. From 2017 to April 2021, Mr. Griggs was a board member and chairman of the audit committee of Nuverra Environmental Solutions, Inc. Mr. Griggs received a Master of Business Administration from the Harvard Business School and a Bachelor of Arts in Liberal Arts from the University of Texas at Austin. |

| | | | | | | | |

| | Chad Lenamon |

| |

Chad Lenamon has served as our Executive Vice President and Chief Operations Officer since January 2023 and has served as the Chief Operating Officer of Kodiak since October 2022. Previously, Mr. Lenamon served as Executive Vice President of Special Projects and Supply Chain of Kodiak Gas LLC (“Kodiak Services”) from October 2019 to October 2022. Prior to joining the Company, Mr. Lenamon spent over 25 years serving in various roles in operations, engineering, fleet management, and supply chain within the natural gas and oil compression industry, including President and Chief Operating Officer of Pegasus Optimization Managers, LLC from July 2017 until its acquisition by the Company in October 2019, and President and Chief Operating Officer of CDM Resource Management, LLC from 2010 to 2015. |

| | | | | | | | |

| | Kelly Battle |

| |

Kelly Battle has served as our Executive Vice President, Chief Legal Officer, Chief Compliance Officer and Corporate Secretary since December 2022. Prior to joining the Company, Ms. Battle was the Vice President, General Counsel and Corporate Secretary at Exterran Corporation, a provider of oil and natural gas production, processing, treating, transportation, and produced water treatment solutions, where she worked for over 18 years in various roles. Prior to joining Exterran Corporation, Ms. Battle was an attorney with Vinson & Elkins from 2000 to 2004 and Clements, O’Neill, Pierce, Nickens, Wilson & Fulkerson from 1996 to 2000. She received her Juris Doctor as well as her Bachelor of Arts, Plan II from the University of Texas at Austin. |

| | | | | | | | |

| | Cory Roclawski |

| |

Cory Roclawski has served as our Executive Vice President and Chief Human Resource Officer since January 2023 and has served as the Chief Human Resource Officer of Kodiak since February 2020. Ms. Roclawski has more than 20 years of experience in human resource leadership and in the midstream, upstream, and oil field services segments. Prior to joining the Company, Ms. Roclawski was the Vice President of Human Resources at Rubicon Oilfield International, LLC from May 2016 to February 2020, and Senior Human Resource Manager at Exterran Corporation from October 2012 to May 2016. She received a Master of Business Administration from Baldwin Wallace University and a Bachelor of Science in Business Administration from Miami University. |

EXECUTIVE COMPENSATION

We are currently considered an “emerging growth company” within the meaning of Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), for purposes of the SEC’s executive compensation disclosure rules. Accordingly, we are required to provide a Summary Compensation Table and an Outstanding Equity Awards at Fiscal Year End Table, as well as limited narrative disclosures regarding executive compensation for our last completed fiscal year. Further, our reporting obligations extend only to the following “Named Executive Officers,” which are the individuals who served as our principal executive officer during the fiscal year ended December 31, 2024 (the “2024 Fiscal Year”) and our next two most highly compensated executive officers at the end of the 2024 Fiscal Year.

| | | | | |

| Name | Position |

| Mickey McKee | President and Chief Executive Officer |

| John Griggs | Executive Vice President and Chief Financial Officer |

| Chad Lenamon | Executive Vice President and Chief Operations Officer |

Summary Compensation Table

The following table summarizes the compensation awarded to, earned by or paid to our Named Executive Officers for the fiscal years ended December 31, 2024, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position

as of December 31, 2024 | | Year | | Salary

($) (1) | | Bonus

($) (2) | | Stock

Awards

($) (3) | | Option

Awards

($) (4) | | Non-Equity

Incentive Plan

Compensation

($) (5) | | All Other

Compensation

($) (6) | | Total

($) |

| Mickey McKee | | 2024 | | 731,749 | | | — | | | 4,358,153 | | | — | | | 833,296 | | | 213,063 | | | 6,136,261 | |

| President and Chief Executive Officer | | 2023 | | 697,692 | | | — | | | 3,111,375 | | | — | | | 1,008,000 | | | 65,701 | | | 4,882,768 | |

| | 2022 | | 650,635 | | | 150,000 | | | — | | | 111,250 | | | 685,819 | | | 36,753 | | | 1,634,457 | |

John Griggs (7) | | 2024 | | 434,071 | | | — | | | 1,361,917 | | | — | | | 394,800 | | | 113,353 | | | 2,304,141 | |

| Executive Vice President and | | 2023 | | 425,000 | | | 75,000 | | | 1,033,413 | | | — | | | 660,000 | | | 39,742 | | | 2,233,155 | |

| Chief Financial Officer | | | | | | | | | | | | | | | | |

| Chad Lenamon | | 2024 | | 463,497 | | | — | | | 1,089,541 | | | — | | | 498,827 | | | 94,513 | | | 2,146,378 | |

| Executive Vice President and | | 2023 | | 396,862 | | | — | | | 829,700 | | | — | | | 660,000 | | | 48,973 | | | 1,935,535 | |

| Chief Operations Officer | | 2022 | | 341,662 | | | 150,000 | | | — | | | 111,250 | | | 271,143 | | | 39,900 | | | 913,955 | |

(1)Amounts in this column reflect the base salary earned by each Named Executive Officer in each of the years shown.

(2)Amounts in this column reflect discretionary one-time bonuses earned by each Named Executive Officer in each of the years shown.

(3)Amounts reported in this column represent the grant date fair value of restricted stock unit awards and performance stock unit awards granted to our Named Executive Officers pursuant to the Omnibus Plan (as defined below) on March 8, 2024 for 2024. The amounts shown in this column were computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 718. The value of the performance stock units reported in the Stock Awards column is based on the probable outcome of the performance conditions (at the award date) in accordance with ASC Topic 718 assuming no forfeitures. For performance stock units awarded in 2024, the grant date values, assuming attainment of the highest performance levels, would be: $4,560,000 for Mr. McKee, $1,425,000 for Mr. Griggs, and $1,140,000 for Mr. Lenamon. For performance stock units awarded in 2023, the grant date values, assuming attainment of the highest performance levels, would be: $3,600,000 for Mr. McKee, $1,080,000 for Mr. Griggs, and $960,000 for Mr. Lenamon. These amounts do not necessarily correspond to the actual value that will be realized by our Named Executive Officers.

(4)Amounts reported in this column reflect the aggregate grant date fair value, computed in accordance with FASB ASC Topic 718, of Class B Units of Frontier TopCo Partners, L.P. (“Kodiak Holdings”) granted to each Named Executive Officer during the 2022 Fiscal Year. In connection with the consummation of the IPO, each Class B Unit granted to Named Executive Officers of Kodiak Holdings was exchanged on a one-for-one basis for Class B Units of Frontier Upper Tier Partnership, LP (“Frontier Holdings”), an affiliate of EQT AB (“EQT”). The Class B Units represent membership interests in Frontier Holdings that are intended to constitute profits interests for federal income tax purposes. Despite the fact that the Class B Units do not require the payment of an exercise price, they are most similar economically to stock options. Accordingly, they are classified as “options” under the definition provided in Item 402(a)(6)(i) of Regulation S-K as an instrument with an “option-like feature.”

(5)The Company maintains long-term and short-term cash-based incentive compensation plans, each with a one-year performance period for 2024. Although no awards were granted in 2024 under the Cash LTIP (as defined below), the Company made payments under this plan in 2024 related to awards granted in 2021, 2022 or 2023. The amounts set forth in this filing for each Named Executive Officer are broken down as follows: (i) for Mr. McKee, $833,296 (all under the STIP (as defined below)); (ii) for Mr. Griggs, $394,800 (all under the STIP); and (iii) for Mr. Lenamon, $498,827 ($60,000 of which was earned under the Cash LTIP and $438,827 of which was earned under the STIP). Please see the “Narrative Disclosure to Summary Compensation Table” below for more details regarding the Company’s STIP and Cash LTIP.

(6)Amounts in this column reflect truck allowances of $17,400 for each NEO, dividend equivalent payments, individual disability insurance premiums, group term life insurance premiums, and 401(k) plan employer matching contributions.

(7)Mr. Griggs has served as the Company’s Executive Vice President and Chief Financial Officer since January 2023.

Narrative Disclosure to Summary Compensation Table

Base Salary

Annualized base salaries for Messrs. McKee, Griggs and Lenamon in 2024 were initially $700,000, $425,000 and $400,000, respectively, and effective February 4, 2024, their base salaries were increased to $735,000, $435,000 and $470,000, respectively.

Short-Term Incentive and Long-Term Incentive Plans

Short-Term Incentive Plan (STIP) Compensation

Under our short-term cash-based incentive compensation plan (the “STIP”), participants earned annual cash awards that were payable based on the achievement of personal, financial and safety target metrics (calculated on an annual basis as the

product of (i) individual earnings, multiplied by (ii) the individual target, multiplied by (iii) a set payout factor). Under our STIP, our Named Executive Officers participated as follows: (a) Mr. McKee earned a discretionary bonus under the STIP with a 120% annual target; (b) Mr. Griggs earned a discretionary bonus under the STIP with a 100% annual target; and (c) Mr. Lenamon earned a discretionary bonus under the STIP with a 100% annual target, with actual STIP amounts calculated based on the achievement of personal, financial and safety metrics.

Long-Term Cash Incentive Plan (LTIP) Compensation

Under our long-term cash-based incentive compensation plan (the “Cash LTIP”), participants earned annual cash awards that were payable in ratable installments over a four-year period based on the achievement of individual performance metrics. The Cash LTIP was discontinued after the company’s IPO in 2023 and no new awards will be granted under this program. Previously granted Cash LTIP awards prior to 2023 continue to vest and be paid out according to their original four-year schedule.

In 2023, Cash LTIP participants, including Messrs. Griggs and Lenamon, with outstanding 2023 Cash LTIP awards were given the option to convert their remaining unpaid cash awards into restricted stock units pursuant to the Omnibus Plan (defined below), which vest in equal installments on January 5 of each of 2024, 2025 and 2026. Both Messrs. Griggs and Lenamon elected to convert their 2023 Cash LTIP awards into restricted stock units in 2023. Mr. McKee does not participate in the Cash LTIP program.

Long-Term Equity Incentive Compensation

Class B Units in Kodiak Holdings

We historically offered long-term equity incentives to our Named Executive Officers through grants of Class B Units in Kodiak Holdings. In connection with the consummation of the IPO, each Class B Unit granted to Named Executive Officers of Kodiak Holdings was exchanged on a one-for-one basis for Class B Units of Frontier Holdings on the same terms and conditions, and as a continuation of, such officer’s Class B Units in Kodiak Holdings. These Class B Unit awards are subject to time- and performance-based vesting requirements, and certain of the Class B Units are entitled to priority catch-up distributions. The Class B Units that are subject to time-vesting are subject to accelerated vesting upon certain change in control events and are subject to potential continued vesting upon the occurrence of certain terminations of employment.

Kodiak Gas Services, Inc. Omnibus Incentive Plan

In connection with the consummation of the IPO in 2023, our Board adopted the Kodiak Gas Services, Inc. Omnibus Incentive Plan (the “Omnibus Plan”) in which our Named Executive Officers, employees, consultants and directors are eligible to participate. The Omnibus Plan provides for the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, stock awards, dividend equivalents, other stock-based awards, cash awards and substitute awards intended to align the interests of service providers, including our Named Executive Officers, with those of our shareholders.

In March 2024, we granted awards to our Named Executive Officers under the Omnibus Plan. The awards granted to our Named Executive Officers in 2024 were comprised of: (i) 40% of restricted stock units and (ii) 60% of performance stock units. The restricted stock units vest ratably on each of the first three anniversaries of the date of grant, subject to such Named Executive Officer’s continued employment through the applicable vesting date. The performance stock units vest based 30% on achievement of each of discretionary cash flow, consolidated net leverage ratio and absolute total shareholder return and 10% on achievement of the Company’s ESG scorecard, in each case, during a three-year performance period and subject to the Named Executive Officer’s continued employment through the applicable vesting date.

We typically grant equity incentive awards to our Named Executive Officers and certain other employees annually. Our Personnel & Compensation Committee generally approves the annual equity incentive awards for Named Executive Officers at its meeting during the first quarter of each year, with awards granted after the filing of our Annual Report for the prior fiscal year. In certain circumstances, the Personnel & Compensation Committee may also approve grants to be effective at other times, including grants for new hires and promotions after our regular annual grant date. Our Board and Personnel & Compensation Committee do not take into account material non-public information when determining the timing or terms of

equity awards, nor do we time disclosure of material non-public information for the purpose of affecting the value of executive compensation. The Company has never awarded stock options (or similar awards).

Additional Narrative Disclosure

Truck Allowances

As of April 1, 2024, our truck allowance program was updated to grandfather in all active employees hired before April 1, 2024. Moving forward, only employees in eligible positions will receive a monthly truck allowance. Each of our Named Executive Officers remained eligible for an annual truck allowance equal to $17,400.

Retirement Benefits

We do not have a defined benefit pension plan or nonqualified deferred compensation plan. We currently maintain a retirement plan intended to provide benefits under Section 401(k) of the Code, pursuant to which employees, including the Named Executive Officers, can make voluntary pre-tax contributions. We match 100% of elective deferrals up to 6% of elective deferrals for all participants. These matching contributions are immediately vested. All contributions under the plan are subject to certain annual dollar limitations, which are periodically adjusted for changes in the cost of living.

Individual Disability and Group Life Insurance

We also maintain an additional disability insurance plan for certain key leadership employees whereby the Company pays 100% of the premiums and a group life insurance plan, which is available to all employees.

Potential Payments Upon Termination or Change in Control

Class B Units

A Named Executive Officer’s outstanding time-vesting Class B Units in Frontier Holdings will become 100% vested upon a “Change of Control” of Frontier Holdings, which is generally the sale of (i) Frontier Holdings’ equity securities pursuant to which an independent third party or parties acquires a majority of the equity securities by vote or value or (ii) all or substantially all of Frontier Holding’s assets on a consolidated basis. Additionally, if a Class B Unit holder’s employment is terminated by Frontier Holdings or one of its subsidiaries without “Cause,” due to the Class B Unit holder’s death or disability or due to the Class B Unit holder’s resignation for “Good Reason,” then, in each case: (a) the time-vesting Class B Units that were scheduled to vest on the next time-vesting date will immediately become vested; (b) the time-vesting Class B Units that remain unvested will remain eligible to fully vest on a change of control that occurs within the nine-month period following such termination (provided that, if a definitive agreement that, if consummated, would result in a change of control is entered into before such nine-month tail period is concluded, then the unvested time-vesting Class B Units will remain eligible to vest on the consummation of such transaction, even if such transaction occurs beyond the nine-month tail period); (c) if such termination occurs within the one-year period following a corporate transaction (which includes any merger, reverse merger or similar corporate transaction that does not constitute a Change of Control), then all unvested time-vesting Class B Units will immediately become vested; and (d) the performance-vesting Class B Units will remain eligible to vest for nine months following such termination.

Restricted Stock Units

In the event a Change in Control (as defined in the Omnibus Plan) is consummated and the restricted stock units are not assumed by the surviving entity in connection with such Change in Control, any unvested portion of the restricted stock units that is outstanding as of immediately prior to the consummation of the Change in Control will automatically vest prior to the Change in Control. Additionally, upon termination of the Named Executive Officer due to death, Disability (as defined in the Omnibus Plan), or upon a Qualifying Termination (as defined in the Executive Severance Plan (as defined below)), any unvested portion of the restricted stock units as of immediately prior to the Named Executive Officer’s termination of service will automatically vest upon such termination of service.

Performance Stock Units

In the event a Named Executive Officer’s termination of service occurs as a result of (i) death, (ii) Disability (as defined in the Omnibus Plan) or (iii) a Qualifying Termination (as defined in the Executive Severance Plan) outside of a Change in Control Protection Period (as defined in the Executive Severance Plan), a pro-rated portion of the outstanding and unvested performance restricted stock units shall immediately vest at the target level of performance.

In the event a Named Executive Officer’s termination of service as a result of a Qualifying Termination during a Change in Control Protection Period, or to the extent the performance stock units are not assumed by the surviving entity in connection with such Change in Control, all outstanding performance stock units will immediately become vested as of such Change in Control, with performance being deemed achieved at the greater of target or actual performance.

Executive Severance Plan

In connection with the IPO, we assumed sponsorship of the Executive Severance Plan of Kodiak Gas Services, Inc. (the “Executive Severance Plan”) previously adopted and approved by Kodiak Gas Services, LLC for Eligible Executives (as defined in the Executive Severance Plan) who are eligible for severance benefits under another individual agreement with the company group, the Executive Severance Plan supersedes all prior agreements, practices, policies, procedures and plans relating to severance benefits.

Upon the termination of an Eligible Executive’s employment due to a Qualifying Termination (as defined in the Executive Severance Plan) that occurs outside of a Change in Control Protection Period (as defined in the Executive Severance Plan), such Eligible Executive is entitled to receive the following severance benefits, payable in a lump sum within 60 days after such Eligible Executive’s Date of Termination (as defined in the Executive Severance Plan): (i) a cash severance payment equal to the product of (A) such Eligible Executive’s Base Salary (as defined in the Executive Severance Plan) and (B) the Applicable Multiple (as defined below); (ii) a pro-rated portion of such Eligible Executive’s Target Annual Bonus (as defined in the Executive Severance Plan), multiplied by a fraction (A) the numerator of which equals the number of calendar days that such Eligible Executive was employed by a member of the Company Group during the calendar year that includes the Date of Termination and (B) the denominator of which equals 365 or 366, as applicable, (the “Pro-Rata Bonus”); and, (iii) a cash payment equal to the product of (A) the annual cost to continue coverage for such Eligible Executive’s group health plan, dental and vision coverage (including coverage for such Eligible Executive’s spouse and eligible dependents), determined under the Company’s group health plans as in effect immediately prior to such Eligible Executive’s Date of Termination and (B) the Applicable Multiple (the “Health Continuation Payment”). For purposes of the Executive Severance Plan, the “Applicable Multiple” means (i) three, for Tier 1 Executives; (ii) two, for Tier 2 Executives; and, (iii) one, for Tier 3 Executives (each as defined in the Executive Severance Plan).

Upon the termination of an Eligible Executive’s employment due to a Qualifying Termination that occurs during a Change of Control Protection Period and so long as such Eligible Executive satisfies the conditions to payment of severance benefits described below, such Eligible Executive shall be entitled to receive the following severance benefits, payable in a lump sum within 60 days after such eligible executive’s Date of Termination: (i) a cash severance payment equal to the product of (A) the sum of such Eligible Executive’s Base Salary and Target Annual Bonus and (B) the Applicable Multiple; (ii) the Pro-Rata Bonus; and, (iii) the Health Continuation Payment.

For purposes of the Executive Severance Plan, Mr. McKee is a Tier 1 Executive and Messrs. Griggs and Lenamon are Tier 2 Executives.

Payment of the severance benefits under the Executive Severance Plan to an Eligible Executive is subject to the Eligible Executive’s (i) execution and non-revocation of a general release of claims in favor of the Company and (ii) continued compliance with the terms of the Executive Severance Plan, including, but not limited to, the restrictive covenants obligations under the Executive Severance Plan.

Outstanding Equity Awards at Fiscal Year End

The following table reflects information regarding outstanding equity-based awards held by our Named Executive Officers as of December 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Grant

Date | | Option Awards (1) | | Stock Awards |

| | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | Option

Exer-

cise

Price

($) | | Option

Expir-

ation

Date | | Number

of shares

or units

of stock

that have

not vested

(#) | | Market

value

of shares

or units

of stock

that have

not vested

($) (2) | | Equity

incentive

plan

awards:

number of

unearned

shares,

units or

other

rights

that have

not vested

(#) | | Equity

incentive

plan

awards:

market or

payout

value of

unearned

shares,

units or

other

rights

that have

not vested

($) (2) |

| Mickey McKee | | 02/15/21 | | 5,880.7 | | (3) | | 17,642.2 | | (4) | | N/A | | N/A | | — | | | | — | | | — | | | | — | |

| 08/15/22 | | 62.5 | | (5) | | 187.5 | | (6) | | N/A | | N/A | | — | | | | — | | | — | | | | — | |

| 07/03/23 | | — | | | | — | | | | N/A | | N/A | | 50,000 | | (11) | | 2,041,500 | | | 112,500 | | (12) | | 4,593,400 | |

| 03/08/24 | | — | | | | — | | | | N/A | | N/A | | 63,669 | | (14) | | 2,599,605 | | | 95,504 | | (15) | | 3,899,400 | |

| John Griggs | | 07/03/23 | | — | | | | — | | | | N/A | | N/A | | 19,167 | | (11) | | 782,589 | | | 33,750 | | (12) | | 1,378,000 | |

| 12/08/23 | | — | | | | — | | | | N/A | | N/A | | 5,450 | | (13) | | 222,524 | | | — | | | | — | |

| 03/08/24 | | — | | | | — | | | | N/A | | N/A | | 19,897 | | (14) | | 812,395 | | | 29,845 | | (15) | | 1,218,600 | |

| Chad Lenamon | | 02/15/21 | | 152.7 | | (7) | | 458.2 | | (8) | | N/A | | N/A | | — | | | | — | | | — | | | | — | |

| 08/15/22 | | 62.5 | | (9) | | 187.5 | | (10) | | N/A | | N/A | | — | | | | — | | | — | | | | — | |

| 07/03/23 | | — | | | | — | | | | N/A | | N/A | | 13,333 | | (11) | | 544,386 | | | 30,000 | | (12) | | 1,224,900 | |

| 12/08/23 | | — | | | | — | | | | N/A | | N/A | | 4,360 | | (13) | | 178,019 | | | — | | | | — | |

| 03/08/24 | | — | | | | — | | | | N/A | | N/A | | 15,918 | | (14) | | 649,932 | | | 23,876 | | (15) | | 974,900 | |

(1)All awards in this table (rounded to the nearest tenth) consist of Class B Units representing membership interests in Kodiak Holdings that are intended to constitute profits interests for federal income tax purposes. Despite the fact that the Class B Units do not require the payment of an exercise price, they are most similar economically to stock options. 25% of each Class B Unit award is subject to time-vesting and the remaining 75% is subject to performance-vesting. The time-vesting Class B Units vest over a five-year period, with 20% of the time-vesting Class B Units vesting on the first anniversary of the specified vesting commencement date, and the remaining 80% vesting in equal installments on each anniversary thereafter, with such time-vesting Class B Units accelerating and becoming fully vested on the occurrence of a change of control, subject (in each case) to the Class B Unit holder’s continuous service with us through the applicable vesting date. The performance-vesting Class B Units vest based on the achievement of certain investor return metrics, subject to the Class B Unit holder’s continuous service with us through the applicable vesting date. See the “Potential Payments Upon Termination or Change in Control” section above for a summary of the treatment of the time-vesting Class B Units on certain sale events.

(2)The amounts in this column were calculated based on $40.83, the closing price of our common stock on the NYSE on December 31, 2024.

(3)2,352.2 of these Class B Units were vested as of the February 15, 2021 grant date, and 1,176.1 of these Class B Units vested on each of February 8, 2022, February 8, 2023 and February 8, 2024.

(4)These Class B Units remain eligible to performance-vest.

(5)37.5 of these Class B Units were vested as of the August 15, 2022 grant date and 12.5 of these Class B Units vested on each of February 8, 2023 and February 8, 2024.

(6)These Class B Units remain eligible to performance-vest.

(7)30.5 of these Class B Units were vested as of the February 15, 2021 grant date, and 30.5 of these Class B Units vested on each of October 24, 2021, October 24, 2022, October 24, 2023 and October 24, 2024.

(8)These Class B Units remain eligible to performance-vest.

(9)25.0 of these Class B Units were vested as of the August 15, 2022 grant date, and 12.5 of these Class B Units vested on each of October 24, 2022, October 24, 2023 and October 24, 2024.

(10)These Class B Units remain eligible to performance-vest.

(11)Represents restricted stock units that will vest one-half on each of July 3, 2025 and July 3, 2026, subject to the Named Executive Officer’s continued employment through each applicable vesting date.

(12)Represents an award of performance stock units assuming target performance that vest based on achievement of a combination of discretionary cash flow, consolidated net leverage ratio, absolute total shareholder return and the Company’s environmental, social and governance (“ESG”} scorecard during the three-year performance period commencing as of June 28, 2023 and ending December 31, 2025, subject to such Named Executive Officer’s continued employment through the relevant certification date. The target amount reported in this column assumes that performance with respect to each of discretionary cash flow, consolidated net leverage ratio and absolute total shareholder return is achieved at 100% and that the ESG scorecard metric has been met. As of December 31, 2024, all performance stock units remained unvested.

(13)Represents restricted stock units in lieu of 2023 cash payments under the Cash LTIP. One-half of the restricted stock units vested on January 5, 2025, with the remaining restricted stock units vesting on January 5, 2026, subject to such Named Executive Officer’s continued employment through each applicable vesting date.

(14)Represents restricted stock units that vested or will vest one-third on each of March 8, 2025, March 8, 2026 and March 8, 2027, subject to the Named Executive Officer’s continued employment through each applicable vesting date.

(15)Represents an award of performance stock units assuming target performance that vest based on achievement of a combination of discretionary cash flow, consolidated net leverage ratio, absolute total shareholder return and ESG scorecard during the three-year performance period commencing as of January 1, 2024 and ending December 31, 2026, subject to such Named Executive Officer’s continued employment through the relevant certification date. The target amount reported in this column assumes that performance with respect to each of discretionary cash flow, consolidated net leverage ratio and absolute total shareholder return is achieved at 100% and that the ESG scorecard metric has been met. As of December 31, 2024, all performance stock units remained unvested.

DIRECTOR COMPENSATION

The Board has adopted a compensation program for our non-employee directors (the “Director Compensation Policy”). The Director Compensation Policy became effective as of July 3, 2023 and continued unchanged through 2024. Pursuant to the Director Compensation Policy, each member of the Board who is not our employee (except for Messrs. Darden and Shah) will receive the following cash compensation for board services, as applicable:

•$80,000 per year for service as a board member;

•$50,000 per year for service as the non-executive chairperson; and

•$20,000 per year for service as chairperson of the Audit & Risk Committee, $15,000 per year for service as chairperson of our Personnel & Compensation Committee and $15,000 per year for service as chairperson of the Nominating, Governance & Sustainability Committee.

In addition, pursuant to the Director Compensation Policy, on the date of each annual meeting, each individual who serves as a non-employee director as of such date and will continue to serve as a non-employee director immediately following such date (except for Messrs. Darden and Shah) will receive grants of restricted stock units with a grant date value equal to approximately $150,000. The restricted stock units will vest on the earlier of (i) the day immediately preceding the date of the first annual meeting following the date of grant and (ii) the first anniversary of the date of grant, in each case, subject to such director’s continuing service on the Board through such dates of vesting. All of a non-employee director’s outstanding restricted stock units shall vest in full immediately prior to the occurrence of a Change in Control (as defined in the Omnibus Plan). Our Director Compensation Policy provides that the equity award shall be granted under and shall be subject to the terms and provisions of our Omnibus Plan and shall be granted subject to the execution and delivery of award agreements.

Director Compensation Table

The following table summarizes the compensation awarded or paid to certain non-employee members of our board of directors for the fiscal year ended December 31, 2024. For summary information on the provision of the plans and programs, refer to the “Director Compensation” discussion immediately preceding this table.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in

Cash

($) (1) | | Stock

Awards

($) (2) | | All Other

Compensation

($) (3) | | Total

($) |

| Randall J. Hogan, III | | 130,000 | | | 150,000 | | | 10,185 | | | 290,185 | |

| Margaret C. Montana | | 80,000 | | | 150,000 | | | 10,185 | | | 240,185 | |

| Gretchen Holloway | | 100,000 | | | 150,000 | | | 10,185 | | | 260,185 | |

| Jon-Al Duplantier | | 95,000 | | | 150,000 | | | 10,185 | | | 255,185 | |

| Chris Drumgoole | | 80,000 | | | 150,000 | | | 10,185 | | | 240,185 | |

| Terry B. Bonno | | 95,000 | | | 150,000 | | | 10,185 | | | 255,185 | |

Alex N. Darden (4) | | 0 | | | 0 | | | 0 | | | 0 | |

Nirav Shah (4) | | 0 | | | 0 | | | 0 | | | 0 | |

(1)Represents fees earned by or paid to our non-employee directors for services during calendar year 2024.

(2)On May 1, 2024, each of our non-employee directors, except for Messrs. Darden and Shah, received an award of 5,519 restricted stock units. The amounts reflected in this column represent the grant date fair value of the restricted stock units granted to each of our non-employee directors pursuant to the Omnibus Plan, as computed in accordance with FASB ASC Topic 718. See Note 14 (“Stockholders’ Equity—2023 Omnibus Incentive Plan”) to Kodiak’s financial statements as of and for the fiscal year ended December 31, 2024 for details.

(3)Represents dividend equivalent payments on unvested restricted stock units.

(4)Kodiak Holdings has designated Messrs. Darden and Shah to serve as members of our Board pursuant to the Kodiak Stockholders’ Agreement (as defined below). Pursuant to the Company’s Director Compensation Policy, Messrs. Darden and Shah did not receive any compensation from Kodiak during 2024.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The descriptions set forth below are qualified in their entirety by reference to the applicable agreements.

Kodiak Holdings

Stockholders’ Agreement