Exhibit 99.2

Powering Our Critical Energy Future February 5, 2026

Exhibit 99.2

Powering Our Critical Energy Future February 5, 2026

Disclaimer Cautionary Note Regarding Forward-Looking Statements. This presentation contains “forward-looking statements” and information based on the current beliefs of Kodiak Gas Services, Inc. (the “Company”). Forward- looking statements in this communication are identifiable by the use of the following words, the negative of such words, and other similar words: “anticipates,” “assumes,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “might,” “plans,” “predicts,” “projects,” “seeks,” “should,” “targets,” “will” and “would.” Important factors that could cause actual results to differ from those indicated in the forward-looking statements in this communication include, but are not limited to: (i) the completion of the acquisition of Distributed Power Services, LLC (“DPS”) by the Company (the “Acquisition”) on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be required on anticipated terms; (ii) the anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the Acquisition, including the possibility that any of the anticipated benefits of the Acquisition will not be realized or will not be realized within the expected time period; (iii) the ability of the Company to integrate its business with DPS’s business successfully and to achieve anticipated synergies and value creation; (iv) the risk that disruptions from the Acquisition will harm the Company’s business, including current plans and operations and that management’s time and attention will be diverted on transaction-related issues; (v) potential adverse reactions or changes to business relationships, including with employees, suppliers, customers, competitors or credit rating agencies, resulting from the announcement or completion of the Acquisition; (vi) potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the Acquisition that could affect the Company’s financial performance and operating results; (vii) certain restrictions during the pendency of the Acquisition that may impact the Company’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business; (viii) legislative, regulatory and economic developments, changes in local, national, or international laws, regulations, and policies affecting the Company; (ix) dilution caused by the Company’s issuance of additional shares of Common Stock in connection with the Acquisition; (x) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (xi) the Company’s ability to employ a sufficient number of skilled and qualified workers to combat the operating hazards inherent in the Company’s industry; (xii) changes in the distributed power industry, including [sustained decreases in the supply of power generators, demand for electricity and distributed power]; (xiii) the competitive nature of distributed power services industry in which the DPS and the Company will conduct its business; (xiv) the impact of adverse weather conditions; (xv) the level of, and obligations associated with, the Company’s indebtedness; (xvi) acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against the Company, and other political or security disturbances; (xvii) the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; and (xviii) other risk factors and additional information. The Company believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical experience and present expectations or projections. These risks and uncertainties include, but are not limited to, those discussed throughout the ‘Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and those discussed throughout the Part I, Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Part II, Item 1A. “Risk Factors” sections of the Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2025, June 30, 2025 and September 30, 2025, which are available on the Investor Relations page of the Company’s website at https:// https://ir.kodiakgas.com// and on the website of the SEC at www.sec.gov. Non-GAAP Financial Measures. This presentation contains certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), including adjusted gross margin, adjusted gross margin percentage, adjusted net income, adjusted EBITDA, adjusted EBITDA percentage, discretionary cash flow and free cash flow. Such non-GAAP measures should not be considered an alternative to, or more meaningful than, the most directly comparable measure of financial performance presented in accordance with GAAP. Moreover, such non-GAAP measures may not be comparable to similarly titled measures of other companies. However, we believe these non- GAAP financial measures provide useful information to investors because, when viewed with our GAAP results and the accompanying reconciliation, they provide a more complete understanding of our performance than GAAP results alone. See the Supplemental Slides for reconciliation of non-GAAP measures. Industry & Market Data. The market data and certain other statistical information used throughout this presentation are based on independent industry publications, government publications or other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates and our management’s understanding of industry conditions. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in these publications. Intellectual Property. This presentation contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

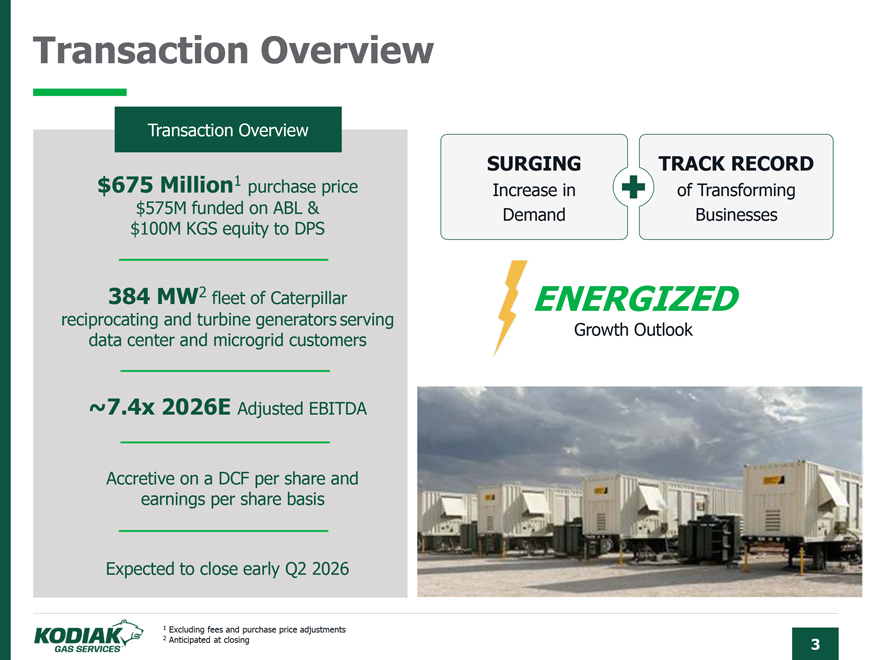

Transaction Overview Transaction Overview 1 SURGING TRACK RECORD $675 Million purchase price Increase in of Transforming $575M funded on ABL & Demand Businesses $100M KGS equity to DPS 384 MW2 fleet of Caterpillar ENERGIZED reciprocating and turbine generators serving Growth Outlook data centerand microgrid customers ~7.4x 2026E Adjusted EBITDA Accretive on a DCF per share and earnings per share basis Expected to close early Q2 2026 1 Excluding fees and purchase price adjustments 2 Anticipated at closing 3

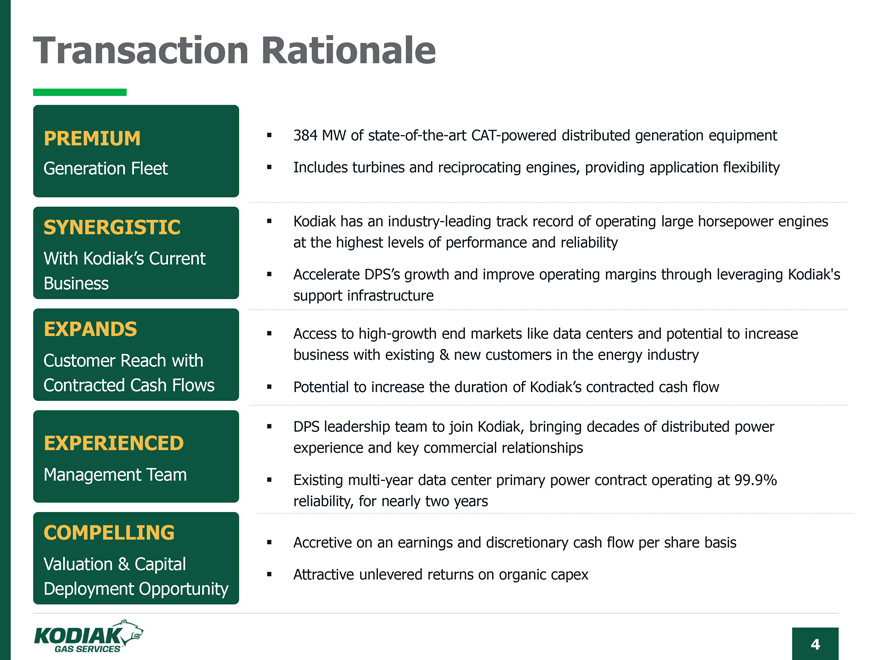

Transaction Rationale PREMIUM 384 MW of state-of-the-art CAT-powered distributed generation equipment Generation Fleet Includes turbines and reciprocating engines, providing application flexibility SYNERGISTIC Kodiak has an industry-leading track record of operating large horsepower engines With Kodiak’s Current at the highest levels of performance and reliability Business Accelerate DPS’s growth and improve operating margins through leveraging Kodiak’s support infrastructure EXPANDS Access to high-growth end markets like data centers and potential to increase Customer Reach with business with existing & new customers in the energy industry Contracted Cash Flows Potential to increase the duration of Kodiak’s contracted cash flow DPS leadership team to join Kodiak, bringing decades of distributed power EXPERIENCED experience and key commercial relationships Management Team Existing multi-year data center primary power contract operating at 99.9% reliability, for nearly two years COMPELLING Accretive on an earnings and discretionary cash flow per share basis Valuation & Capital Attractive unlevered returns on organic capex Deployment Opportunity 4

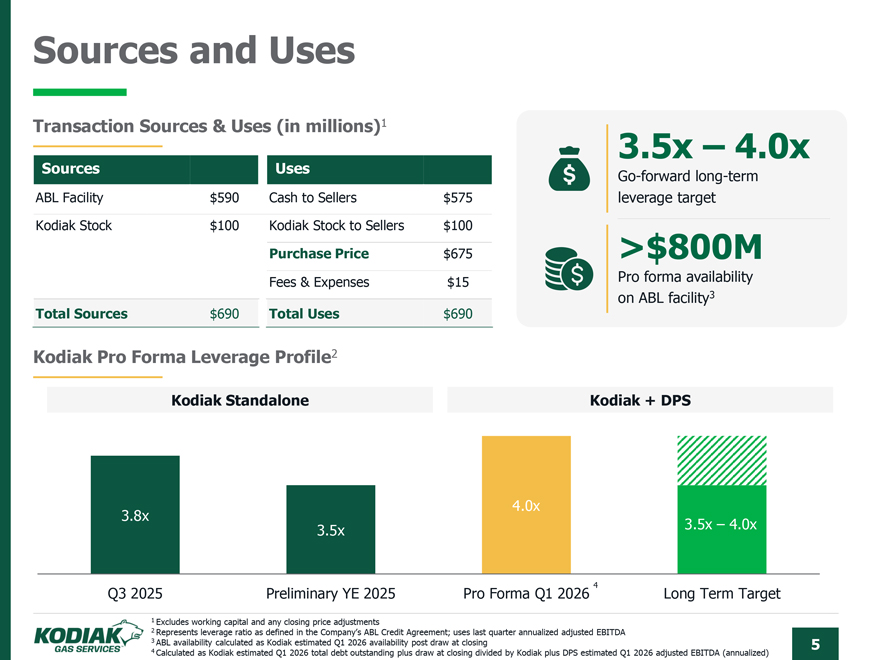

Sources and Uses Transaction Sources & Uses (in millions)1 Sources Uses 3.5x – 4.0x Go-forward long-term ABL Facility $590 Cash to Sellers $575 leverage target Kodiak Stock $100 Kodiak Stock to Sellers $100 Purchase Price $675 >$800M Fees & Expenses $15 Pro forma availability on ABL facility3 Total Sources $690 Total Uses $690 Kodiak Pro Forma Leverage Profile2 Kodiak Standalone Kodiak + DPS 4.0x 3.8x 3.5x 3.5x – 4.0x Q3 2025 Preliminary YE 2025 Pro Forma Q1 2026 4 Long Term Target 1 Excludes working capital and any closing price adjustments 2 Represents leverage ratio as defined in the Company’s ABL Credit Agreement; uses last quarter annualized adjusted EBITDA 3 ABL availability calculated as Kodiak estimated Q1 2026 availability post draw at closing 5 4 Calculated as Kodiak estimated Q1 2026 total debt outstanding plus draw at closing divided by Kodiak plus DPS estimated Q1 2026 adjusted EBITDA (annualized)

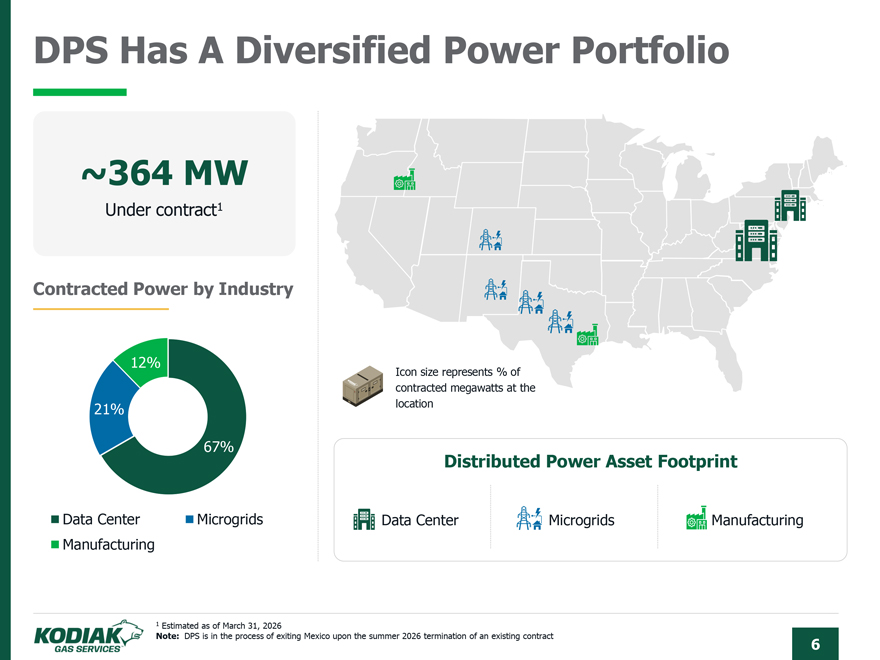

DPS Has A Diversified Power Portfolio ~364 MW Under contract1 Contracted Power by Industry 12% Icon size represents % of contracted megawatts at the 21% location 67% Distributed Power Asset Footprint Data Center Microgrids Data Center Microgrids Manufacturing Manufacturing 1 Estimated as of March 31, 2026 Note: DPS is in the process of exiting Mexico upon the summer 2026 termination of an existing contract 6

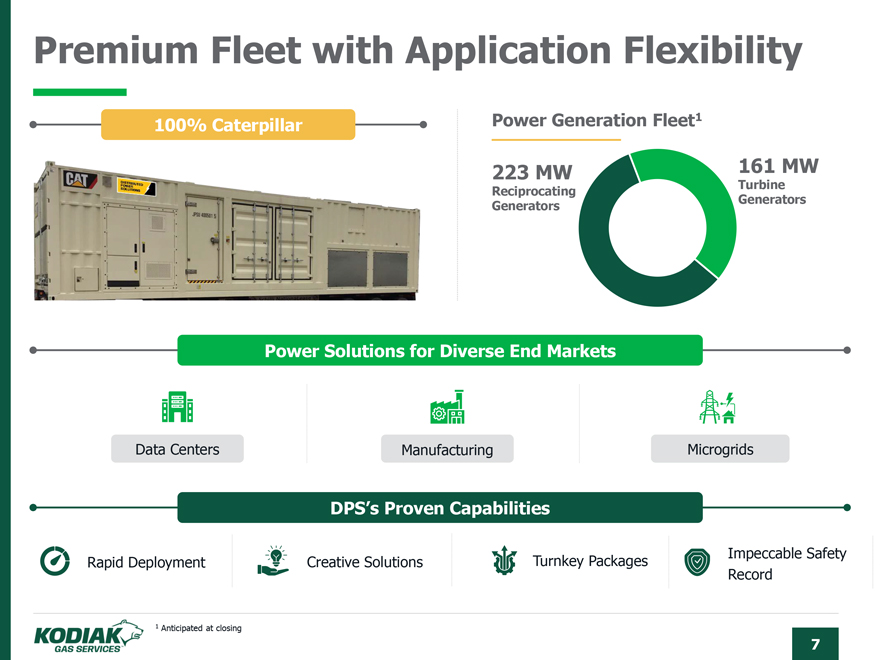

Premium Fleet with Application Flexibility 100% Caterpillar Power Generation Fleet1 223 MW 161 MW Turbine Reciprocating Generators G enerators Power Solutions for Diverse End Markets Data Centers Manufacturing Microgrids DPS’s Proven Capabilities Impeccable Safety Rapid Deployment Creativ

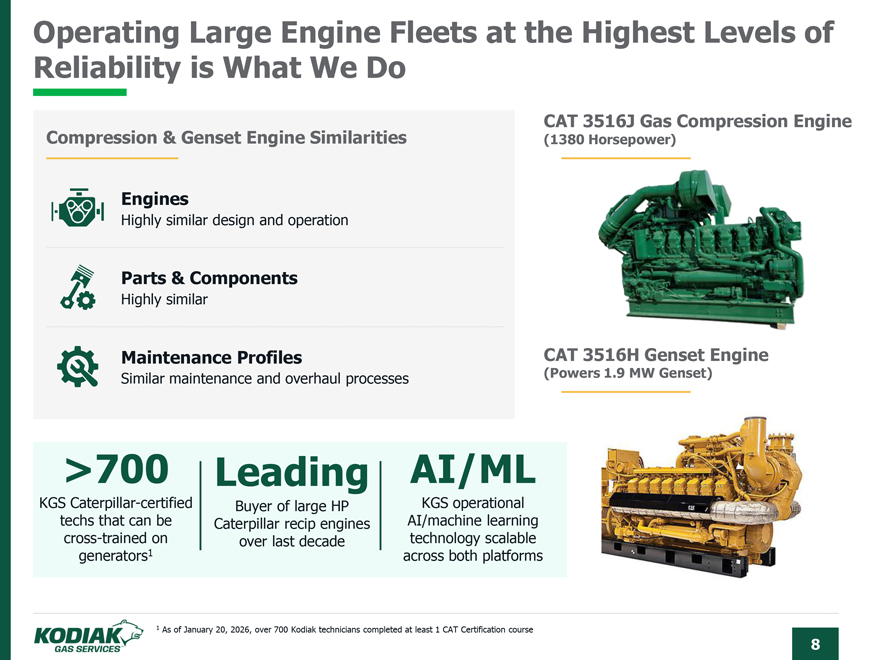

e Solutions Turnkey Packages Record 1 Anticipated at closing 7 Operating Large Engine Fleets at the Highest Levels of Reliability is What We Do CAT 3516J Gas Compression Engine Compression & Genset Engine Similarities (1380 Horsepower) Engines Highly similar design and operation Parts & Components Highly similar Maintenance Profiles CAT 3516H Genset Engine Similar maintenance and overhaul processes (Powers 1.9 MW Genset) >700 Leading AI/ML KGS Caterpillar-certified Buyer of large HP KGS operational techs that can be Caterpillar recip engines AI/machine learning cross-trained on over last decade technology scalable generators1 across both platforms 1 As of January 20, 2026, over 700 Kodiak technicians completed at least 1 CAT Certification course 8

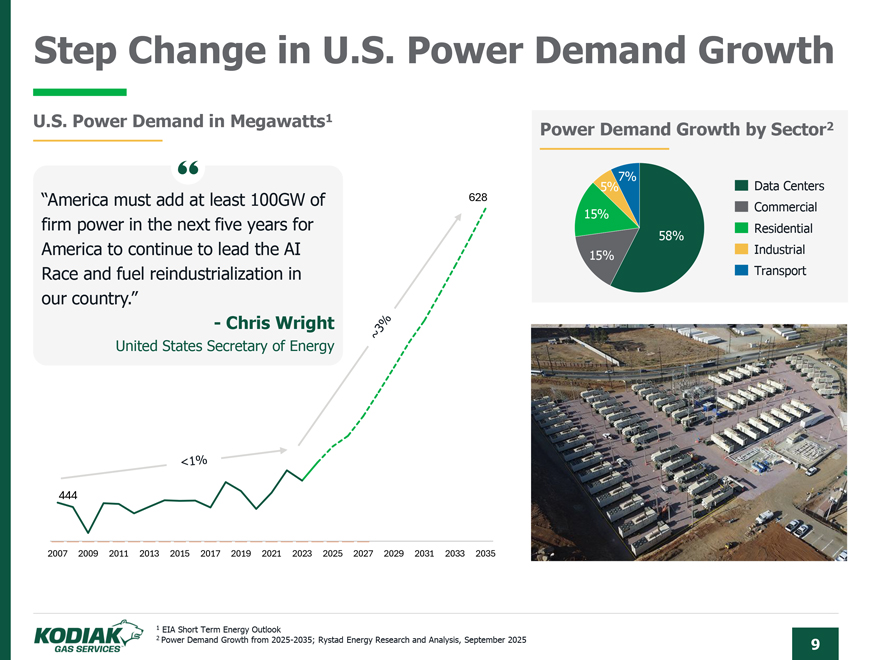

Step Change in U.S. Power Demand Growth U.S. Power Demand in Megawatts1 Power Demand Growth by Sector2 7% 5% Data Centers “America

must add at least 100GW of 628 Commercial 15% firm power in the next five years for Residential 58%

America to continue to lead the AI 15% Industrial Race and fuel

reindustrialization in Transport our country.” - Chris Wright United States Secretary of Energy 444 2007 2009 2011 2013 2015 2017 2019 2021 2023 2025 2027 2029 2031 2033 2035 1 EIA Short Term Energy Outlook 2 Power Demand Growth from

2025-2035; Rystad Energy Research and Analysis, September 2025 9

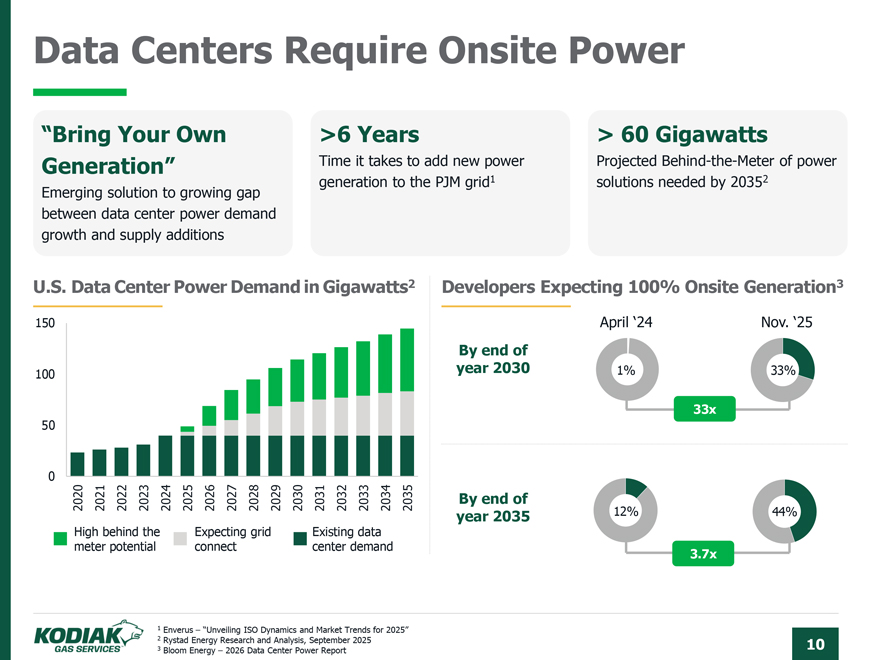

Data Centers Require Onsite Power “Bring Your Own >6 Years > 60 Gigawatts Generation” Time it takes to add new power Projected Behind-the-Meter of power Emerging solution to growing gap generation to the PJM grid1 solutions needed by 20352 between data center power demand growth and supply additions U.S. Data Center Power Demand in Gigawatts2 Developers Expecting 100% Onsite Generation3 150 April ‘24 Nov. ‘25 By end of 100 year 2030 1% 33% 33x 50 0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 By end of 12% 44% year 2035 High behind the Expecting grid Existing data meter potential connect center demand 3.7x 1 Enverus – “Unveiling ISO Dynamics and Market Trends for 2025” 2 Rystad Energy Research and Analysis, September 2025 10 3 Bloom Energy – 2026 Data Center Power Report

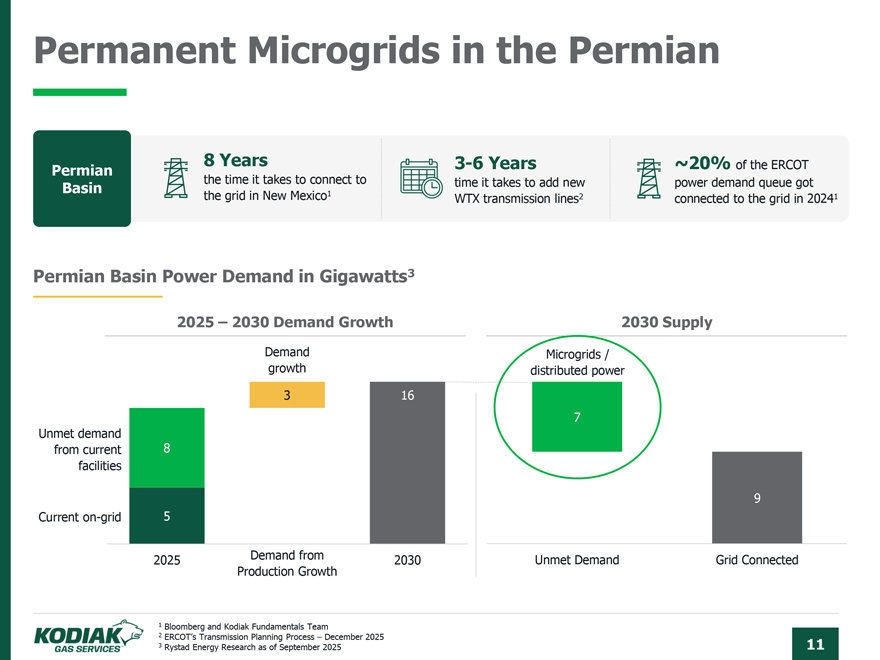

Permanent Microgrids in the Permian 8 Years 3-6 Years ~20% of the ERCOT Permian the time it takes to connect to time it takes to add new power demand queue got Basin 1 the grid in New Mexico WTX transmission lines2 connected to the grid in 20241 Permian Basin Power Demand in Gigawatts3 2025 – 2030 Demand Growth 2030 Supply Demand Microgrids / growth distributed power 3 16 7 Unmet demand from current 8 facilities 9 Current on-grid 5 2025 Demand from 2030 Unmet Demand Grid Connected Production Growth 1 Bloomberg and Kodiak Fundamentals Team 2 ERCOT’s Transmission Planning Process – December 2025 3 Rystad Energy Research as of September 2025 11

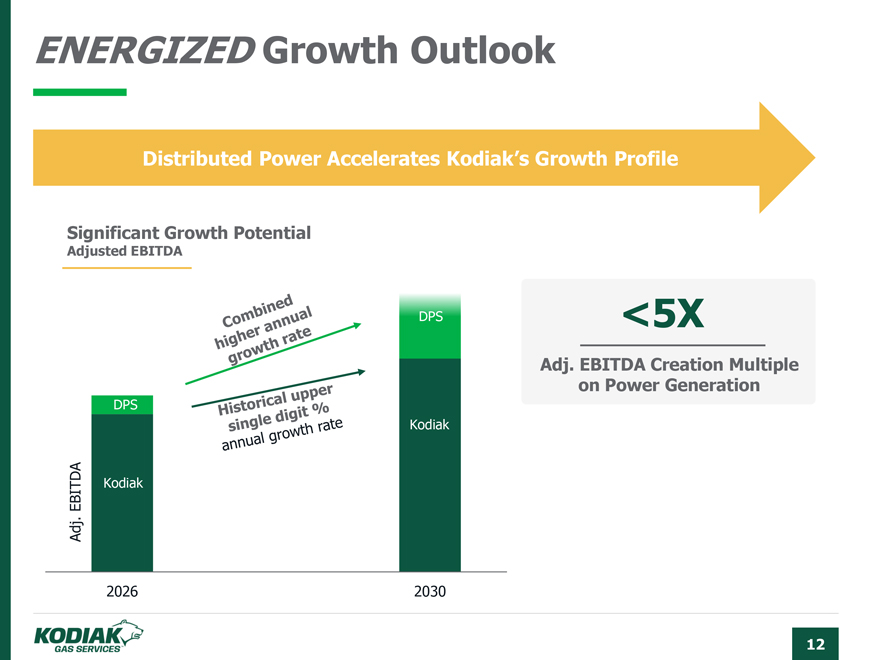

ENERGIZED Growth Outlook Distributed Power Accelerates Kodiak’s Growth Profile Significant Growth Potential Adjusted EBITDA DPS <5X Adj. EBITDA Creation Multiple on Power Generation Kodiak DPS Kodiak EBITDA Kodiak . Adj 2026 2030 12

Contact Us IR@KODIAKGAS.COM