CRITICAL. ENERGY. INFRASTRUCTURE. Exhibit 99.2

Disclaimer Forward-Looking Statements This presentation contains, and our officers and representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. In particular, this presentation includes (without limitation) forward-looking information pertaining to: the anticipated financial performance of the combined entity; the expected run rate synergies and efficiencies to be achieved as a result of the transaction; expected accretion to discretionary cash flow; expectations regarding the leverage and dividend profile of the combined entity; expansion and growth of the business; Kodiak’s plans to finance the transaction; and the receipt of all necessary approvals to close the transaction and the timing associated therewith. This forward-looking information is based on assumptions, estimates and analysis made by Kodiak and its perception of trends, current conditions and expected developments, as well as other factors that are believed by Kodiak to be reasonable and relevant in the circumstances and in light of the transaction. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Kodiak’s control. Actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause Kodiak’s actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: the satisfaction of closing conditions to the transaction in a timely manner, if at all; receipt of all necessary regulatory and/or competition approvals on terms acceptable to Kodiak; the ability of the combined entity to realize the anticipated benefits of, and synergies from, the transaction and the timing and quantum thereof; consequences of not completing the transaction, including the volatility of the equity price of Kodiak, negative reactions from the investment community; actions taken by government entities or others seeking to prevent or alter the terms of the transaction; potential undisclosed liabilities unidentified during the due diligence process; the accuracy of the pro forma financial information of the combined entity; the success of business integration and the time required to successfully integrate; the focus of management’s time and attention on the transaction and other disruptions arising from the transaction; the ability to maintain desirable financial ratios; the ability to access various sources of debt and equity capital, generally, and on acceptable terms; the ability to maintain relationships with partners and to successfully manage and operate integrated businesses; and such other factors as discussed throughout the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Kodiak’s final prospectus filed with the SEC on June 30, 2023 pursuant to Rule 424(b)(4) and throughout Part I, Item 2. "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Part II, Item 1A. "Risk Factors" sections of Kodiak’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023. Any forward-looking statement made in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. Except as may be required by applicable law, Kodiak undertakes no obligation to publicly update any forward-looking statement whether as a result of new information, future developments or otherwise.

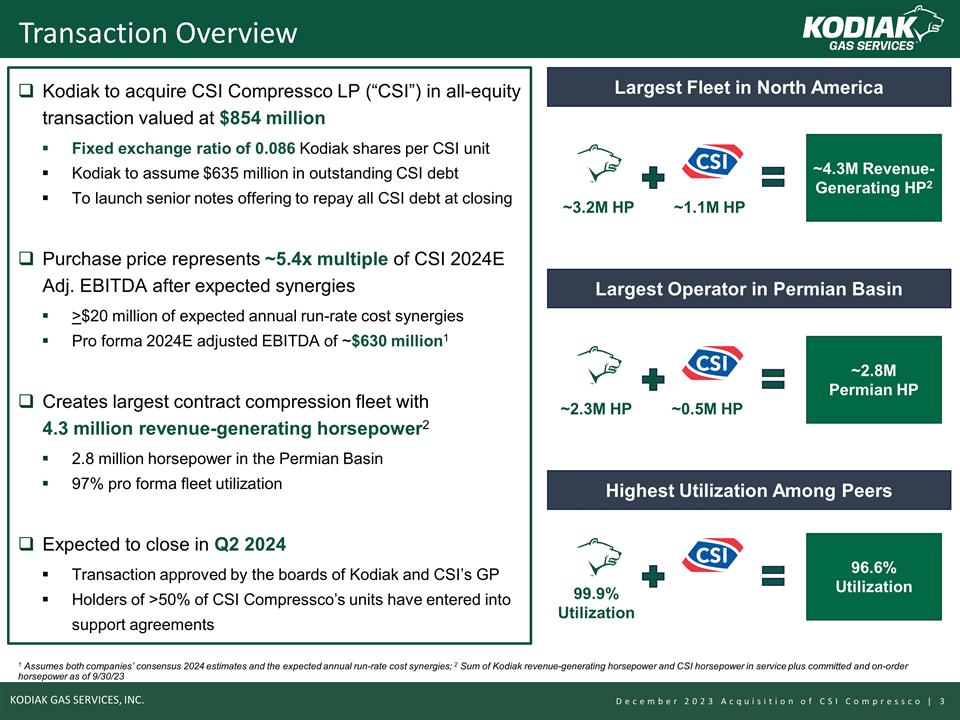

Transaction Overview Kodiak to acquire CSI Compressco LP (“CSI”) in all-equity transaction valued at $854 million Fixed exchange ratio of 0.086 Kodiak shares per CSI unit Kodiak to assume $635 million in outstanding CSI debt To launch senior notes offering to repay all CSI debt at closing Purchase price represents ~5.4x multiple of CSI 2024E Adj. EBITDA after expected synergies >$20 million of expected annual run-rate cost synergies Pro forma 2024E adjusted EBITDA of ~$630 million1 Creates largest contract compression fleet with 4.3 million revenue-generating horsepower2 2.8 million horsepower in the Permian Basin 97% pro forma fleet utilization Expected to close in Q2 2024 Transaction approved by the boards of Kodiak and CSI’s GP Holders of >50% of CSI Compressco’s units have entered into support agreements 1 Assumes both companies’ consensus 2024 estimates and the expected annual run-rate cost synergies; 2 Sum of Kodiak revenue-generating horsepower and CSI horsepower in service plus committed and on-order horsepower as of 9/30/23 ~3.2M HP ~1.1M HP ~4.3M Revenue-Generating HP2 ~2.3M HP ~0.5M HP ~2.8M Permian HP 99.9% Utilization 96.6% Utilization Largest Operator in Permian Basin Highest Utilization Among Peers Largest Fleet in North America

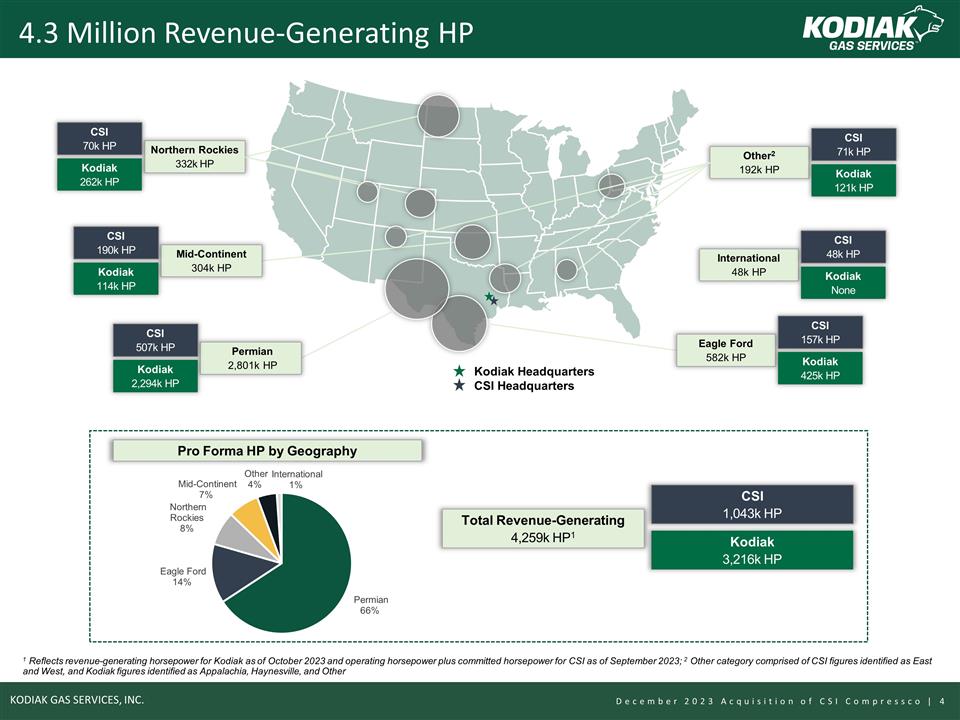

4.3 Million Revenue-Generating HP 1 Reflects revenue-generating horsepower for Kodiak as of October 2023 and operating horsepower plus committed horsepower for CSI as of September 2023; 2 Other category comprised of CSI figures identified as East and West, and Kodiak figures identified as Appalachia, Haynesville, and Other Kodiak Headquarters CSI Headquarters Permian 2,801k HP CSI 507k HP Kodiak 2,294k HP Total Revenue-Generating 4,259k HP1 CSI 1,043k HP Kodiak 3,216k HP Northern Rockies 332k HP CSI 70k HP Kodiak 262k HP Other2 192k HP CSI 71k HP Kodiak 121k HP Mid-Continent 304k HP CSI 190k HP Kodiak 114k HP International 48k HP CSI 48k HP Kodiak None Eagle Ford 582k HP CSI 157k HP Kodiak 425k HP Pro Forma HP by Geography

Key Transaction Benefits Attractive Transaction Economics Immediately accretive to Discretionary Cash Flow and Free Cash Flow per share At least $20 million of high-confidence annual cost synergies Transaction value of ~5.4x 2024 consensus Adjusted EBITDA including synergies Leverage-neutral to Kodiak; long-term leverage target of 3.0x – 3.5x by year end 2025 Complementary Compression Assets Increases size and scale of fleet Opportunity to generate higher utilization across CSI fleet Investments in large HP units have substantially high-graded CSI’s fleet Deepen Geographic Footprint and Expand Customer Base Presence in the Permian and South Texas augments Kodiak’s existing footprint Fixed-revenue contracts with blue chip customers Limited customer overlap Natural Extension of Diversified Service Offerings Broader service offerings via CSI’s natural gas treating / cooling and aftermarket services Potential for cross-selling opportunities

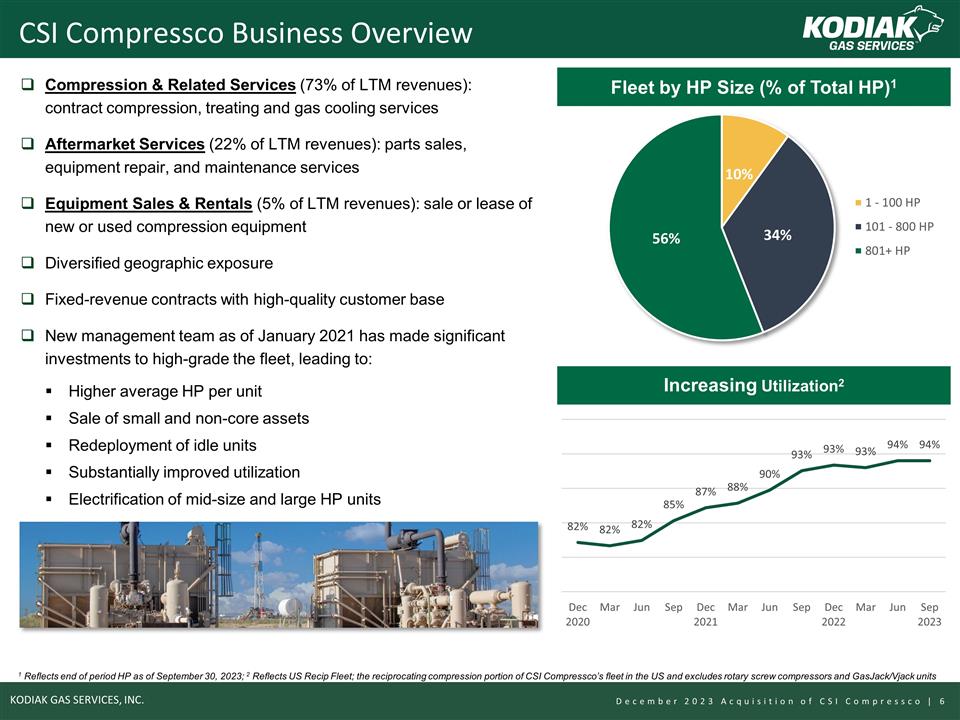

CSI Compressco Business Overview Fleet by HP Size (% of Total HP)1 Compression & Related Services (73% of LTM revenues): contract compression, treating and gas cooling services Aftermarket Services (22% of LTM revenues): parts sales, equipment repair, and maintenance services Equipment Sales & Rentals (5% of LTM revenues): sale or lease of new or used compression equipment Diversified geographic exposure Fixed-revenue contracts with high-quality customer base New management team as of January 2021 has made significant investments to high-grade the fleet, leading to: Higher average HP per unit Sale of small and non-core assets Redeployment of idle units Substantially improved utilization Electrification of mid-size and large HP units 1 Reflects end of period HP as of September 30, 2023; 2 Reflects US Recip Fleet; the reciprocating compression portion of CSI Compressco’s fleet in the US and excludes rotary screw compressors and GasJack/Vjack units Increasing Utilization2

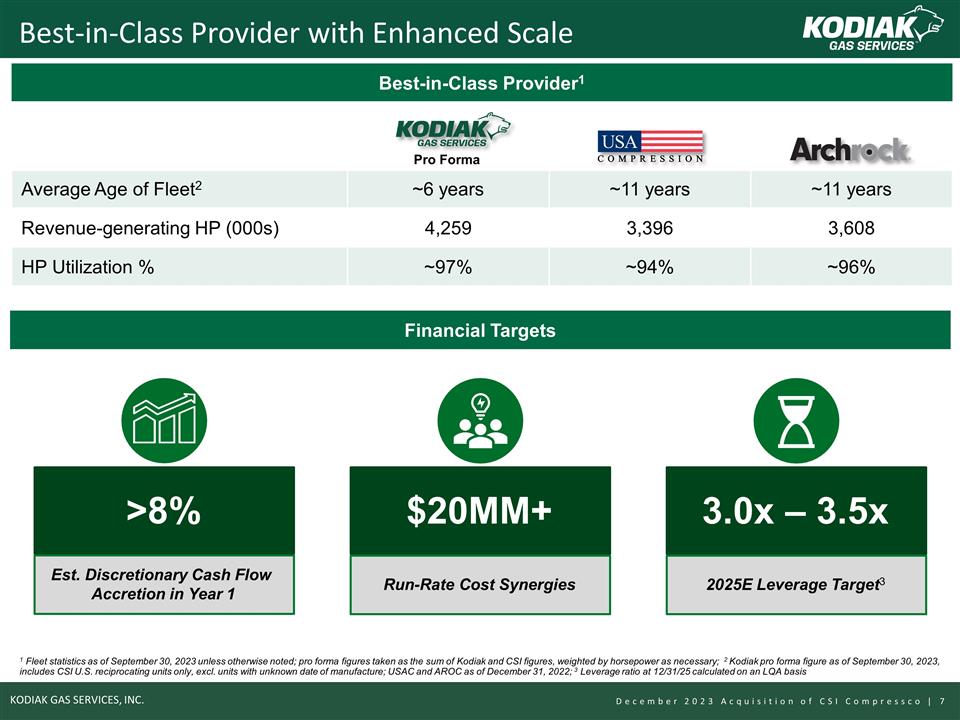

Best-in-Class Provider with Enhanced Scale Best-in-Class Provider1 Average Age of Fleet2 ~6 years ~11 years ~11 years Revenue-generating HP (000s) 4,259 3,396 3,608 HP Utilization % ~97% ~94% ~96% Pro Forma 1 Fleet statistics as of September 30, 2023 unless otherwise noted; pro forma figures taken as the sum of Kodiak and CSI figures, weighted by horsepower as necessary; 2 Kodiak pro forma figure as of September 30, 2023, includes CSI U.S. reciprocating units only, excl. units with unknown date of manufacture; USAC and AROC as of December 31, 2022; 3 Leverage ratio at 12/31/25 calculated on an LQA basis Financial Targets 3.0x – 3.5x 2025E Leverage Target3 >8% Est. Discretionary Cash Flow Accretion in Year 1 $20MM+ Run-Rate Cost Synergies