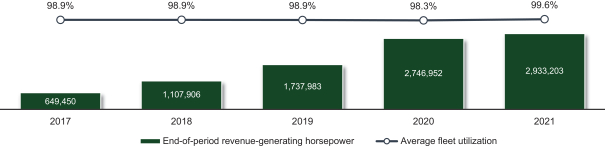

provided or are capable of being provided) of over 99.5% since inception. The strength of our customer relationships and contract structures, combined with the reliability and critical nature of our assets, have resulted in a five-year 99% average fleet utilization (which measures the revenue-generating horsepower divided by our total fleet horsepower).

Below is a presentation of our average fleet utilization and our total revenue-generating horsepower since 2017:

Countries around the world are moving toward a lower carbon future while providing secure low-cost sources of energy for their citizens. Recent world events have resulted in renewed attention on environmentally responsible and secure energy production provided by the U.S., and we are committed to continuing to play a meaningful role in our industry. We are focused on being the most resilient and sustainable enterprise, and we have ambitious sustainability goals. We will continue to innovate processes and technologies to assist our customers in meeting their emission reduction goals, while striving to provide a safe, inclusive and supportive environment for our employees and the communities where we operate. Finally, we intend to do business with integrity and ethics and maintain a corporate governance structure that includes appropriate oversight and transparency in all aspects of our operations.

Our Business Model

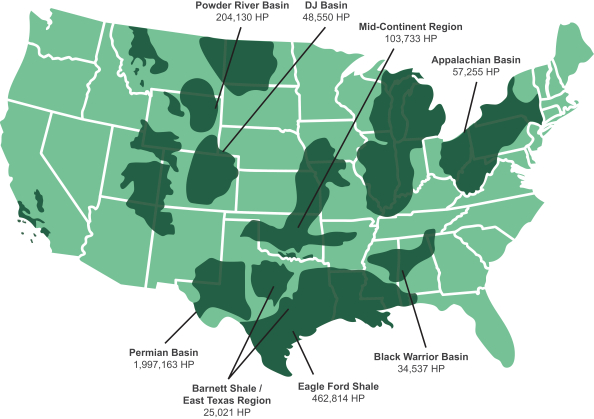

Our business model is focused on large horsepower contract compression operations, which we believe is central to our customers’ efforts to meet the expected growing natural gas and oil demand from the Permian Basin and other regions in the U.S. Large horsepower compression operations allow us to enter into longer-term contracts that we believe are more predictable and stable for us and our customers. We believe our focus on customer service in top-tier regions, and the critical nature of our assets results in long-term customer relationships and financial stability for our business.

Our preventative and predictive maintenance and overhaul programs are designed to maximize mechanical availability and extend the useful lives of our assets over multiple decades. These programs allow us to contract all of our compression assets at rates that are comparable to our newest compression units. Our standardized fleet also enables streamlined and systematic training and on-site maintenance maximizing uptime for our customers. We are developing advanced systems to proactively analyze and monitor the operating conditions of our equipment, allowing for maximum uptime for our customers. Our maintenance culture is foundational to our partnership-focused business model and allows us to provide over 99.5% mechanical availability to our customers.

We believe that our customers will continue to outsource their compression infrastructure needs allowing them to limit their capital investments in compression equipment and increase their free cash flow or deploy capital on projects directly related to their core businesses. By outsourcing compression infrastructure, customers can

2